Contents page

Token allocation refers to the distribution of tokens among the various stakeholders of a blockchain project. The beneficiaries can include the project team, investors, strategic partners, the community, or users.

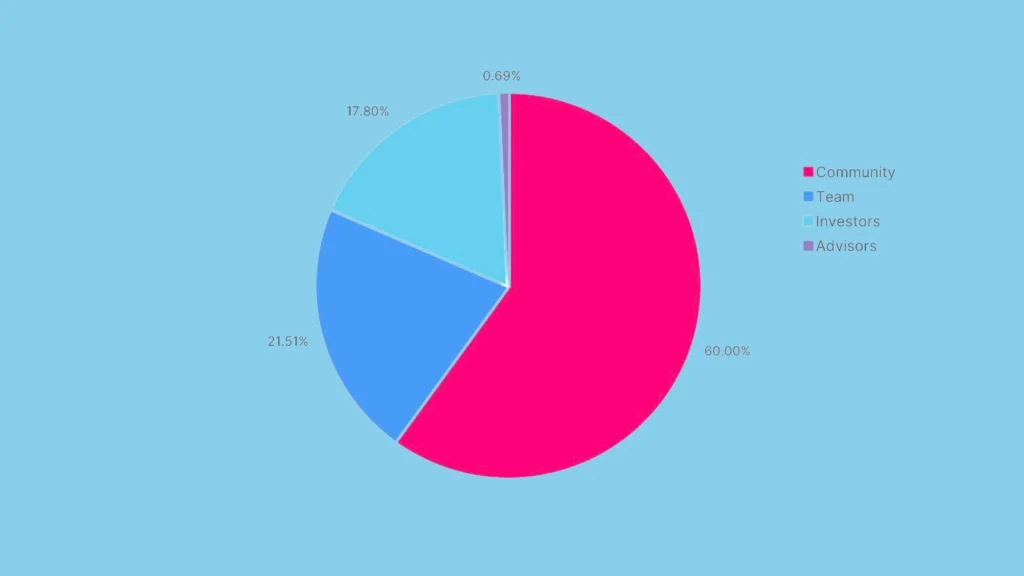

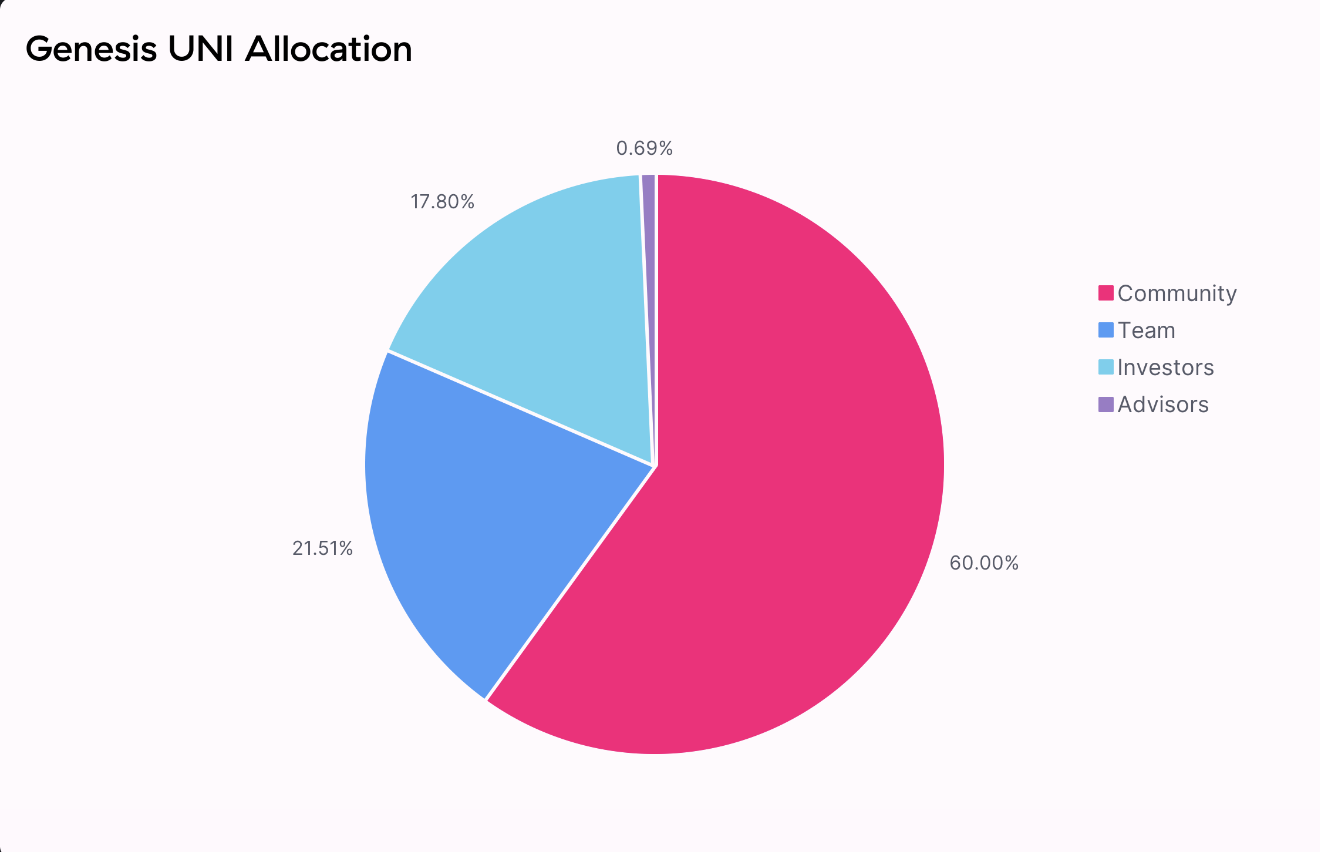

This distribution is often detailed in the project’s whitepaper and is typically represented in a pie chart, as illustrated below.

For instance, the initial allocation of the UNI token from Uniswap is as follows: 60% of the tokens are allocated to the community, 21.51% to the team, 17.80% to investors, and 0.69% to advisors.

With a max supply of 1 billion, this represents 600 million UNI for the community, 215.1 million for the team, 178 million for investors, and 6.9 million for advisors.

Why is token allocation important?

Token allocation is a central aspect of tokenomics. Understanding and managing it well is crucial for several reasons.

Preventing centralization and market manipulation

Proper token allocation helps prevent excessive concentration of power. Projects distribute tokens among different stakeholders such as investors, team members, and the community. This prevents control from being monopolized by a minority. Additionally, for projects concerned with governance, a balanced allocation ensures fairness, allowing different interests within the community to be represented.

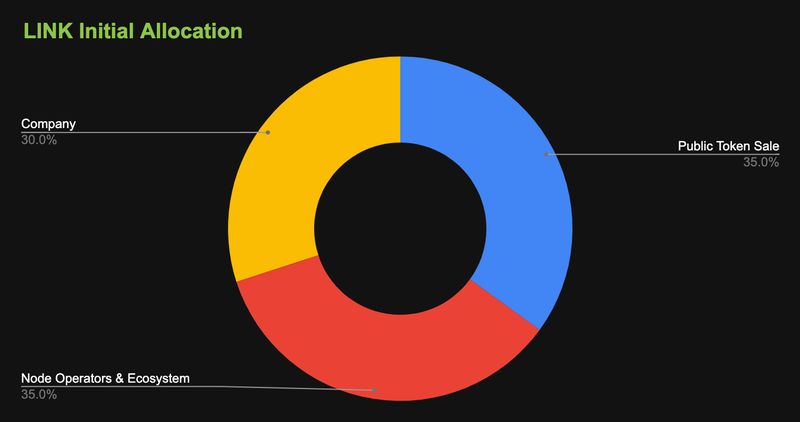

Chainlink initially allocated its token supply in a balanced manner, with 35% reserved for public sale participants, 30% for the company, and 35% for node operators and the ecosystem. This distribution diversifies power and reduces the risk of market manipulation by avoiding token concentration within a single group.

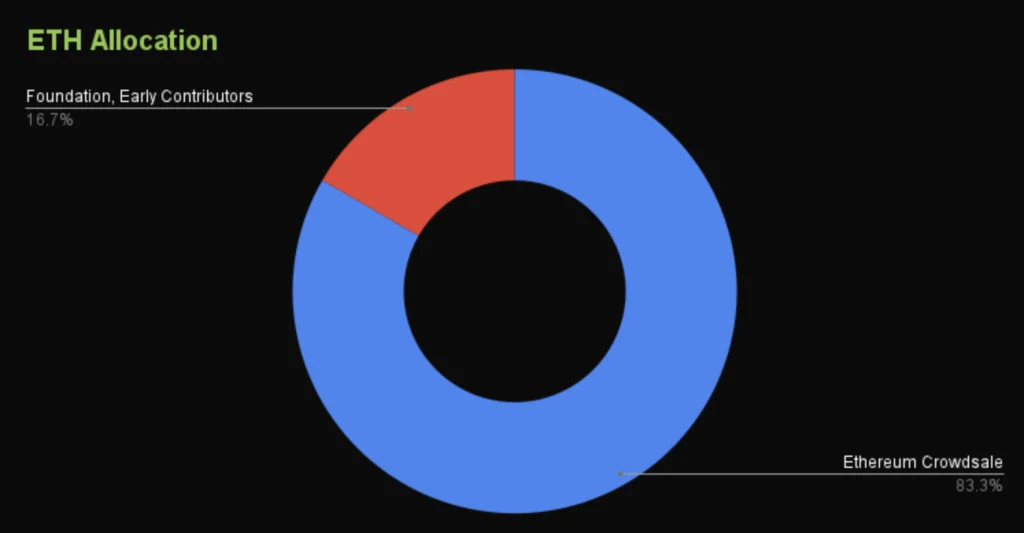

When Ethereum launched in 2014, 83.3% of its tokens were allocated to its ICO. This made Ether accessible to a wide range of investors and users. This approach reduced the risk of centralization by distributing tokens among many participants, minimizing the likelihood of control or manipulation by a small group. The Ethereum Foundation kept 16.7% of the tokens to support the project’s development and future.

Valuing stakeholders and encouraging active participation

A well-planned token allocation ensures that all project contributors, including users, are fairly rewarded. This fosters community engagement and aligns the interests of all stakeholders with the project’s goals. It promotes adoption and encourages active participation from users and investors within the ecosystem. As a result, all stakeholders are motivated to help the project succeed, investing more in its development, which supports long-term sustainable growth.

- Example of a poor community allocation

Imagine a project where 55% of the tokens are allocated to the founders and team, 40% to private investors, leaving only 5% for the community. Such an imbalance leads to a centralization of power between the team and investors, potentially discouraging community engagement and participation, as they may feel undervalued and underrepresented. This allocation strategy creates a significant imbalance and could jeopardize the project’s long-term success.

Optimizing the success of the initial fundraising

A well-designed token allocation can attract investors by offering them tokens at a favorable price during presale phases. The funds raised during these sales are essential for projects to finance development and promotion.

Moreover, investors are attentive to how tokens are allocated. This directly affects the future value of their investments. Poor token allocation can lead to excessive price volatility and unfavorable conditions for investors. This can damage their trust and engagement. On the other hand, a balanced allocation aligned with the project’s objectives contributes to market stability, avoiding massive token sell-offs or a limited supply. A clear and transparent allocation can thus attract more investment.

Main token allocation categories

Projects can use different token allocation categories, each aimed at specific goals and uses. Therefore, the token distribution is unique to each project, and simulations can be performed to determine the optimal allocation for each category.

However, while these categories may vary from project to project, some are frequently found within tokenomics models.

Private investors (VC, business angels, …)

The allocation for private investors typically falls into categories such as private sales, seed rounds, Series A, or strategic rounds. These allocations aim to raise funds for the project in exchange for tokens.

The targets of these allocations generally include institutional investors, venture capital firms such as Andreessen Horowitz (a16z) or Animoca Brands, business angels like Naval Ravikant, as well as investors close to the project (personal contacts).

The challenge in allocating tokens to private investors is to raise the necessary funds without granting them too much power, as they typically do not represent the project’s end users. Therefore, it is essential to set attractive conditions, such as a competitive token price, to attract these investors and meet funding goals. However, it is equally important to moderate this attractiveness and the allocated percentage to avoid compromising or distorting the project.

Public investors (ICO, IDO, IEO, …)

Public sales, such as ICOs, IDOs, and IEOs, play an important role in distributing tokens. They allow projects to raise funds and sell the first tokens to potential users, reaching a wider audience and promoting adoption and awareness of the project.

The percentage of tokens allocated to this category should align with the project’s fundraising goals, determined by multiplying the sale price by the number of tokens allocated.

Founders and project team

Allocating tokens to the founders and team members is essential to ensure their long-term commitment. These tokens, awarded as rewards or compensation, recognize and value their work in developing and operating the project. Furthermore, allocating an appropriate percentage ensures that the team remains motivated and retains its members by fairly rewarding their contributions.

This allocation often includes a cliff and vesting period, aligning the team’s interests and motivation with the project’s long-term goals.

Advisors and partners

Advisors and partners provide expertise to the project or help increase its visibility. To reward them for their contribution and motivate them to stay involved, a portion of the tokens can be allocated to them. This allocation strengthens their commitment and integrates them into the project’s long-term vision.

Community and rewards (staking, airdrops, …)

In blockchain projects, the community and users are among the most important stakeholders. Without them, the project would not exist. Therefore, allocating a portion of the tokens to this category is often crucial, even essential, depending on the project’s nature and goals.

This allocation aims to encourage participation and community engagement. It often includes a portion dedicated to staking rewards, airdrops, and other incentives, rewarding users for their involvement and actions.

Liquidity

Liquidity is crucial to ensure that tokens are easily accessible and tradable. A portion of the tokens must be allocated to liquidity to create pools on decentralized exchanges (DEX) and centralized exchanges (CEX). This allocation helps maintain market stability by avoiding significant price fluctuations due to insufficient liquidity, which could lead to large price swings during buying or selling.

Treasury

The treasury acts as a reserve to finance future development, community initiatives, and other operational needs of the project. Depending on the project’s profile, it may be beneficial to allocate a portion of tokens to the treasury to ensure its longevity and support its long-term growth.

Key Takeaways

- Token allocation refers to the distribution of tokens among the stakeholders of a blockchain project.

- It is often communicated in the whitepaper, typically in the form of a pie chart.

- A well-thought-out allocation can prevent the centralization of power and reduce the risk of market manipulation.

- It can also reward contributors and encourage active user participation.

- An optimized allocation also helps maximize the success of the initial fundraising.

- The most common allocation categories include private investors, public investors, founders and team, advisors and partners, community and rewards, liquidity, and treasury.

thanks ))

[…] project token allocation is entirely free and usually only takes a few minutes. Make sure you do this with any projects you […]