Contents page

The cliff is a key concept in tokenomics, associated with token distribution and release strategies. It directly influences the initial circulating supply at the time of a project’s launch. This plays a role in market price stability by reducing selling pressure when the tokens become available.

Understanding the cliff

A cliff refers to a period that usually starts at the token launch (TGE). During this time, holders do not have access to their tokens, meaning they cannot sell or transfer them.

Let’s take an example of a 6-month cliff applied to team members who receive 10% of the total supply. During this period, they will not have access to their tokens. After the 6 months, without further conditions, the team members will receive all of their tokens. They will then be able to sell, trade, or hold them.

This lock-up period often precedes the vesting process, where tokens are gradually released (see our article on vesting for more details).

Although the cliff usually starts at the TGE, it can be adjusted based on the project’s needs. For instance, a development team may receive tokens with a 3-month cliff from their hiring date, rather than from the TGE. So, even if the token has already launched, their tokens will be locked for 3 months after they join the team.

Importance of the cliff

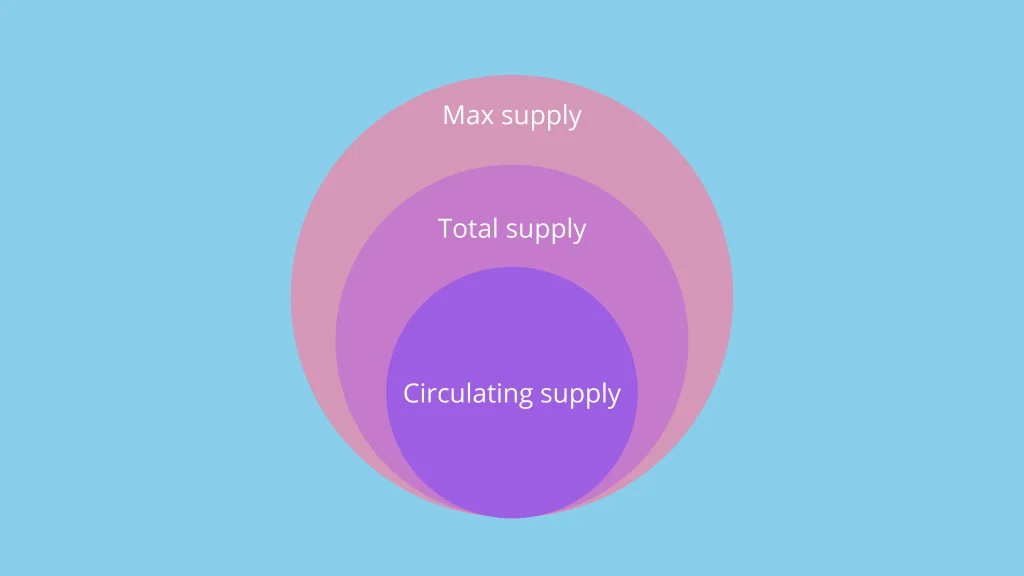

The primary goal of this token lock-up period is to reduce selling pressure and stabilize token prices during the launch (TGE). It helps avoid a sudden and massive release of tokens into the market. By locking tokens during an initial period, the cliff limits the initial circulating supply. This prevents value dilution caused by an excess supply relative to demand. By restricting immediate token sales by holders, the cliff helps maintain a limited supply, supporting better token valuation.

This mechanism also allows the project to develop, reach its audience, and grow a community before tokens are released. It fosters more sustainable demand and sets the stage for a gradual token release that will meet established demand, rather than facing the potentially insufficient demand seen in the early stages of a project.

The cliff also helps deter short-term profit seekers. This type of investor, focused on quick gains, can cause excessive price volatility through early sales. As a result, the cliff refocuses demand on engaged users and investors who believe in the project long-term or intend to actively use the token.

Using the cliff

Cliffs are commonly used for private investors, as well as team members and advisors.

However, it’s important to carefully manage the use of the cliff. Excessively reducing the initial circulating supply can lead to demand outweighing supply. This may cause a sudden and artificial price increase due to token scarcity, potentially followed by sharp price drops once locked tokens are released.

Key takeaways

- The cliff is a mechanism used to delay token access.

- The cliff prevents a massive release of tokens, limiting the initial circulating supply.

- It helps stabilize token prices by reducing immediate selling pressure.

- It is commonly used for private investors, team members, and advisors.

- The cliff must be carefully managed to avoid sudden price increases followed by sharp drops caused by temporary token scarcity.

- It encourages long-term investors and users rather than buyers motivated by short-term profits.