Contents page

Tokenomics, a fusion of the terms “token” and “economics”, is an essential pillar in the economy of blockchain projects. It focuses on the study and analysis of economic flows within Web3 projects.

Definition of tokenomics

Tokenomics sits at the intersection of traditional economics and blockchain technology. It examines supply, demand, inflation, distribution, and incentive mechanisms. Additionally, it analyzes how these elements affect the creation, capture, and retention of a token’s value. It also explores the utility and functionality of tokens within a blockchain project.

Tokenomics encompasses various mechanisms, ranging from token allocation and distribution to the optimization of flows and liquidity management. It also includes critical aspects such as governance. The goal is to understand how different incentives affect the supply and demand of a token and ultimately its price.

Thus, tokenomics plays a role similar to that of a central bank on a smaller scale, orchestrating the economy of a blockchain project. The main difference is that economic rules are predefined in the token’s code. By establishing and regulating these rules, tokenomics positions itself at the heart of the Web3 revolution. It proves to be a central pillar in the design, development, and longevity of blockchain projects. Its goal is to build a viable and sustainable economic model for the project.

A well-designed tokenomics creates a prosperous ecosystem where tokens have utility, value, and a sustainable future. Conversely, poor tokenomics can lead to extreme volatility, low demand, and negatively impact the long-term viability of a project.

Components of tokenomics

Supply

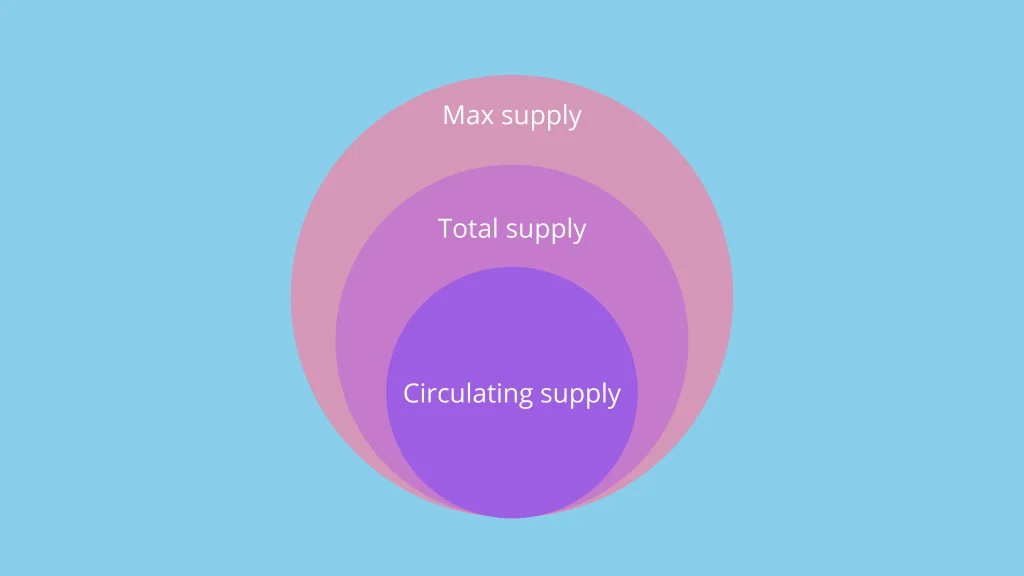

The supply of a token refers to the total quantity of tokens that will be available and how this quantity will evolve over time. There are primarily two categories : circulating supply and total supply.

- Circulating supply : The number of tokens currently available and tradable in the market.

- Total supply : The entirety of existing tokens, including those locked or reserved within smart contracts.

Some projects adopt an approach with no maximum supply limit. This allow for a continuous increase in the number of tokens. Others, like Bitcoin, impose a fixed token supply.

Managing supply through mechanisms such as token burns or halving is essential to control inflation and stimulate the token’s value. A deflationary strategy, aimed at reducing the available supply over time, can be particularly effective in enhancing a token’s scarcity and, consequently, its market value.

In tokenomics, supply plays a crucial role in determining a token’s value. Strategies implemented by projects to manage this supply aim to create value, thereby fostering a stable or growing economy with a sustainable long-term model.

Demand

The demand for a token is influenced by its utility and associated incentive mechanisms.

The utility of a token can be diverse :

- Access to project services

- Means of payment

- Payment of transaction fees

- Exclusive benefits or governance participation

These multiple utilities make tokens indispensable within their ecosystem, positively influencing their demand.

Incentive mechanisms, such as staking or participation rewards, play an important role. They encourage token holders to stay invested, thereby increasing demand. User motivation to buy tokens from the start, remain engaged, and continue investing in the project is essential. This can manifest through profit-sharing, such as airdrops and fee discounts. Or, through staking mechanisms allowing token holders to earn rewards by contributing to the network’s security and transaction validation.

Demand directly affects a token’s value, underscoring the importance of developing well-thought-out tokenomics to ensure a project’s long-term success.

Token allocation and distribution

Token allocation and distribution play a key role in determining the initial distribution of tokens among different stakeholders. Fair allocation and transparency are essential to build trust and motivate active user participation in the project.

In addition, an effective distribution model aims to ensure a gradual release of tokens through mechanisms such as cliff and vesting periods. These methods aim to reduce the risk of hyperinflation of the circulating supply, which could dilute token value. By preventing massive sales, these mechanisms limit sudden price fluctuations and protect the token’s value. Moreover, they encourage stakeholders to maintain their long-term commitment, significantly contributing to the project’s growth and success.

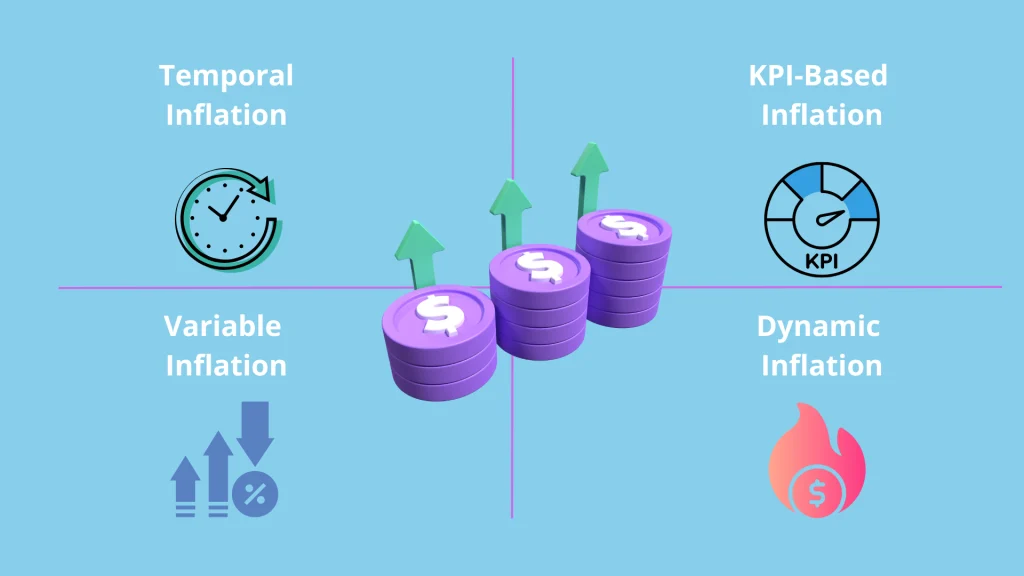

Token emissions

Token emissions refer to the process by which new tokens are created and introduced into the ecosystem. This process, often defined by the project’s code, is essential to regulate the token supply, manage inflation, and stimulate user participation.

Mining and staking are two methods facilitating token emission. Its reward active user engagement in distinct ways. Mining, specific to the proof-of-work (PoW) consensus mechanism, involves verifying and adding transactions to the blockchain. Miners are rewarded with newly issued tokens, in addition to transaction fees for their contribution. In contrast, staking, part of the proof-of-stake (PoS) consensus, requires participants to lock up a certain number of tokens. This action gives them the ability to validate transactions and add new blocks to the blockchain, with rewards being newly issued tokens.

Liquidity

Liquidity plays a fundamental role in the tokenomics of blockchain projects, potentially exerting both positive and negative influences on projects. It ensures the ease of token exchange in markets without significantly impacting their price. Maintaining an appropriate level of liquidity is essential to allow token holders to buy or sell quickly without causing significant price fluctuations. Effective liquidity management is indispensable for maintaining investor confidence and ensuring token price stability.

Examples of tokenomics

Bitcoin

Bitcoin is the first blockchain project, laying the foundations for tokenomics.

With a maximum supply of 21 million BTC, its native token, Bitcoin incentivizes miners to secure the network by awarding them newly created tokens. This mining mechanism encourages users to hold BTC and protect the network, facilitating the progressive issuance of BTC through the rewards they receive. Additionally, Bitcoin employs the halving mechanism, which halves miner rewards every 210,000 blocks, reducing the issued supply over time to control inflation and create scarcity. Each circulating BTC has been mined, with no pre-mining or early sale, ensuring fair distribution.

Ethereum

Ethereum, the second-largest blockchain by market capitalization after Bitcoin, uses Ether (ETH) as its native token.

Unlike BTC, ETH does not have a limited quantity, initially making it inflationary. However, since the “The Merge” update on September 15, 2022, Ethereum has adopted a token burn mechanism. This new mechanism now promotes a deflationary economic model. Indeed, the implemented burn mechanism eliminates more ETH than it creates, thus reducing the circulating supply, decreasing token inflation, and potentially increasing its long-term value.

The growing demand for Ethereum is primarily driven by the central utility of ETH : paying transaction fees, essential for operations of decentralized applications (dApps) anchored on the platform.