Contents page

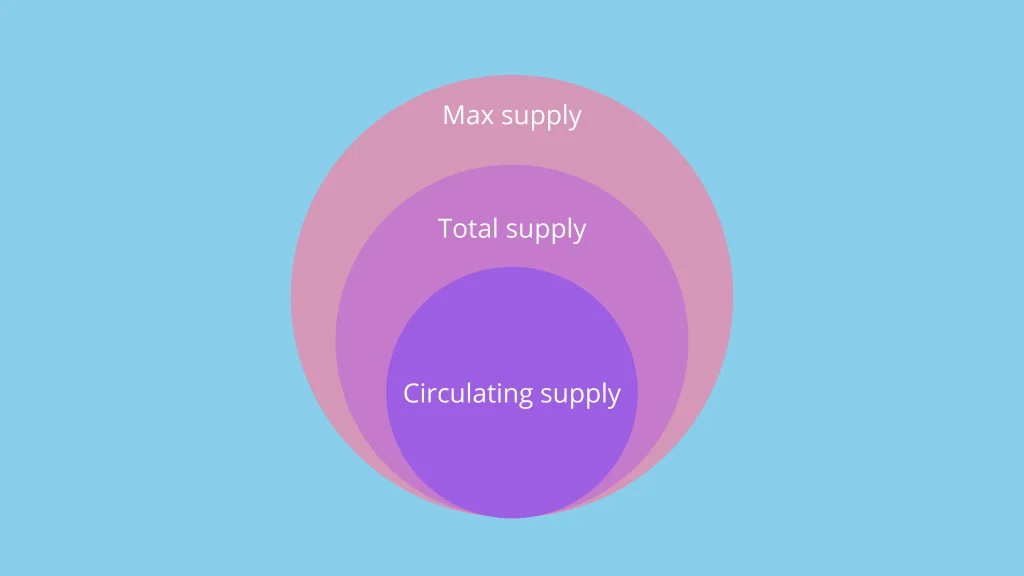

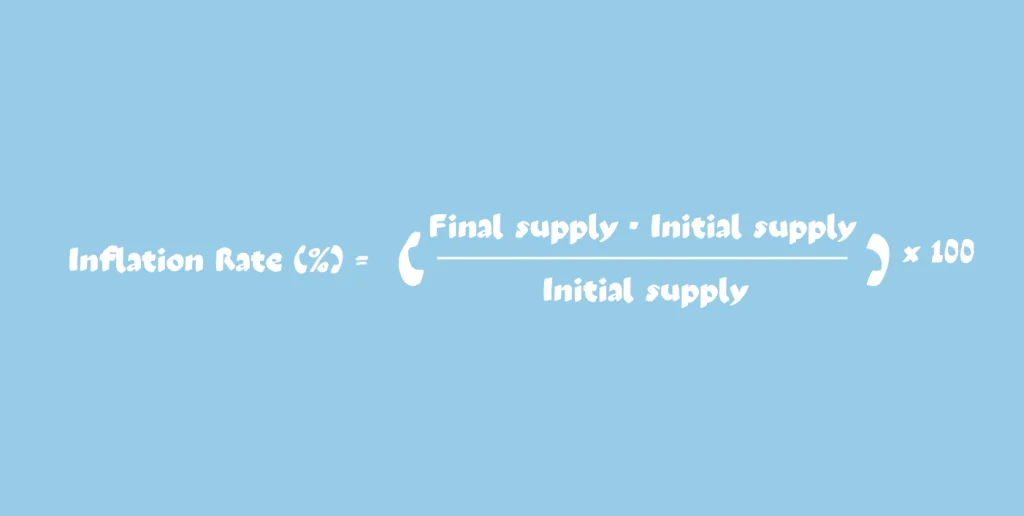

In tokenomics, inflation refers to the gradual increase in the supply of tokens in circulation. Effective management of inflation stimulates participation, strengthens network security, and ensures liquidity while fostering the growth of the blockchain project.

However, excessive inflation dilutes token value and disrupts the balance between supply and demand, which can undermine user and investor confidence. Conversely, insufficient inflation limits adoption and slows the project’s expansion.

To regulate inflation, mechanisms such as halving or burning are frequently used.

🔎 Learn more about inflation in tokenomics: Inflation in tokenomics

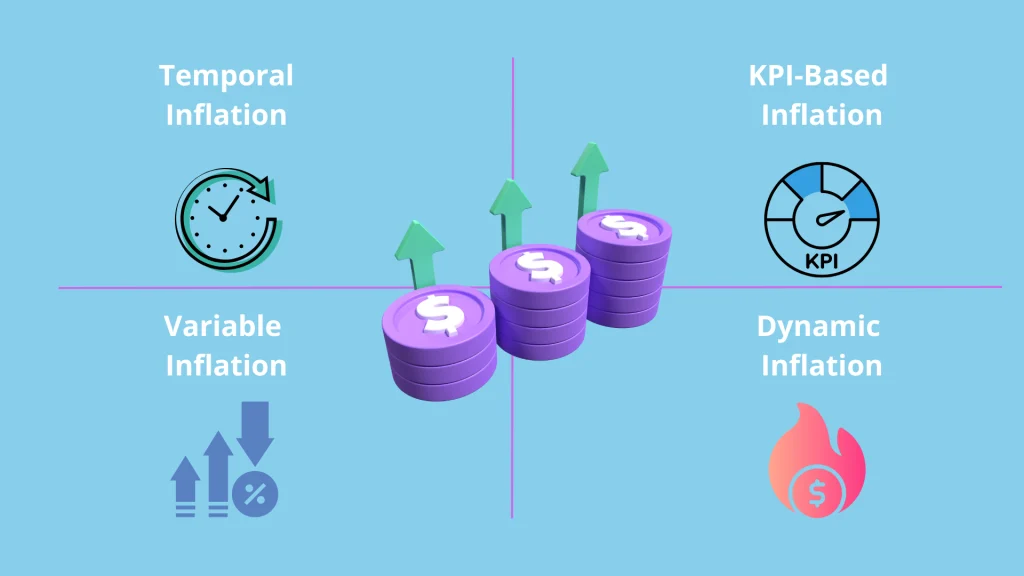

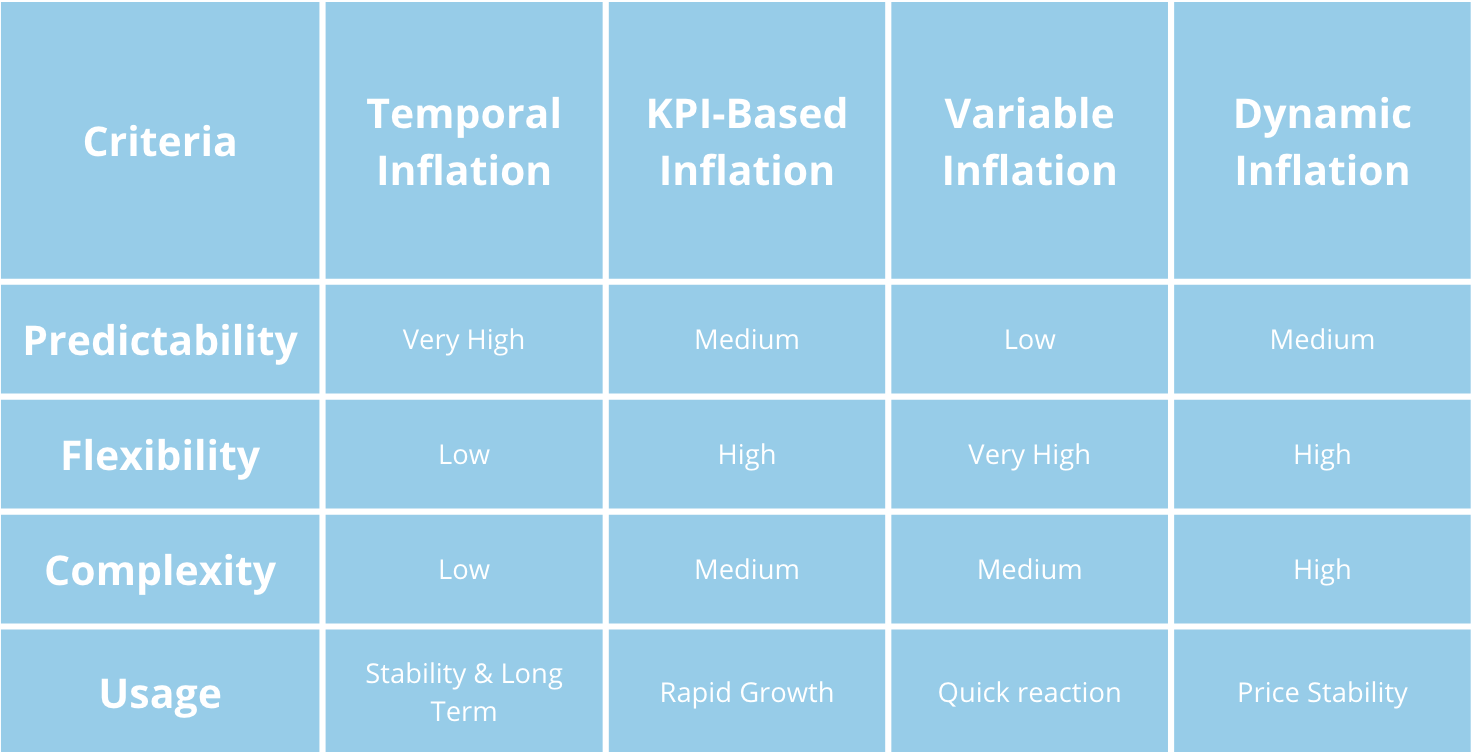

The types of inflation in tokenomics are classified into four main categories: temporal, KPI-based, variable, and dynamic. Each model serves specific objectives and adapts to different stages of blockchain project maturity.

Temporal Inflation

Temporal inflation follows a predefined schedule set at the project’s launch. This model is widely adopted due to its predictability.

- Mechanism: New tokens are issued at regular intervals, often until a maximum supply is reached.

- Example: Bitcoin (BTC) is a good example of this model. Each mined block creates new bitcoins as a reward for miners. This process gradually increases the bitcoin supply until it reaches a maximum of 21 million bitcoins. Additionally, the halving mechanism reduces issuance every four years, progressively slowing inflation.

Advantages of Temporal Inflation

- Predictability and Transparency. By following a precise schedule, this model offers high predictability. Token holders can anticipate future issuances, reinforcing their confidence.

- Economic Stability. Economic planning gains reliability through a predefined framework, attracting participants seeking tokens with limited supply and well-controlled inflation, thus encouraging a long-term vision.

Disadvantages of Temporal Inflation

- Dependence on Continuous Demand. To preserve token value, demand must grow at the same rate as supply. If not, an imbalance between supply and demand may arise, leading to token devaluation.

- Risk of Overinflation. In the absence of new users or declining interest in the project, an increasing supply can result in overinflation, reducing token value and profitability for existing holders.

KPI-Based Inflation

KPI-based inflation ties token issuance directly to a project’s success and performance.

- Mechanism: Tokens are issued in proportion to the achievement of key performance indicators (KPIs), such as market capitalization, provided liquidity, or user participation levels.

- Example: Balancer (BAL) adjusts rewards based on the liquidity provided by users in different liquidity pools. The more liquidity added to a strategic or prioritized pool, the greater the BAL token rewards for liquidity providers. This mechanism incentivizes users to actively support the ecosystem by providing funds while strengthening essential pools for the protocol’s growth.

Advantages of KPI-Based Inflation

- Alignment with Network Performance. By linking token issuance to performance indicators, this model ensures supply increases only when the project progresses, reducing unnecessary inflation risks.

- Encouragement of Active Growth. Participants are motivated to contribute actively to the project’s success since their rewards are directly tied to its performance, strengthening the ecosystem.

- Flexible Issuance. This model allows continuous and dynamic token issuance adjustments, avoiding over-issuance that could devalue tokens in cases of underperformance.

Disadvantages of KPI-Based Inflation

- Complexity in Defining and Monitoring KPIs. Choosing the right performance indicators is crucial but complex. Poorly selected KPIs could lead to issuances that do not reflect the actual value created for the network, making token issuance inefficient or counterproductive.

- Risk of Indicator Manipulation. Some stakeholders might attempt to manipulate KPIs to maximize rewards, potentially harming the model’s transparency and viability.

Variable Inflation

Variable inflation is a flexible issuance model where token supply adjusts based on demand, with non-predetermined and sometimes random variations.

- Mechanism: Token supply increases or decreases in real time to respond to market fluctuations, adapting issuance to liquidity needs.

- Example: Tether (USDT) exemplifies this model. This stablecoin adjusts its supply to maintain parity with the U.S. dollar, fluctuating according to liquidity needs. When USDT demand rises, new tokens are issued. Conversely, tokens are removed from circulation if demand decreases, ensuring price stability around $1.

Advantages of Variable Inflation

- High Flexibility. This model enables instant adaptation, adjusting token supply according to current market demand, which is particularly useful in volatile markets.

- Liquidity Preservation. By issuing additional tokens during demand spikes, variable inflation ensures increased availability for users, reducing shortages and facilitating transactions even in high-volatility periods.

- Price Stabilization. By adjusting supply to demand, this model helps maintain a stable token value, minimizing excessive volatility.

Disadvantages of Variable Inflation

- Reduced Predictability. Continuous supply adjustments make it difficult to anticipate the total number of tokens in circulation, discouraging investors who prefer assets with predictable supply and value.

- Complexity for Token Holders. The variable supply can lead to unpredictable price volatility, complicating investment and planning strategies.

Dynamic Inflation

Dynamic inflation adjusts token supply based on market conditions, primarily to stabilize the price. This mechanism helps keep the token within a target price range through continuous supply adjustments.

- Mechanism: When the token price falls below a predefined threshold, supply is reduced, typically through a burn mechanism. Conversely, new tokens are minted when the price exceeds an upper threshold, ensuring a constant balance between supply and demand.

- Example: Cosmos (ATOM) employs a dynamic inflation model by adjusting its inflation rate based on the percentage of staked tokens. If staking rates are low, inflation increases to offer more attractive rewards, incentivizing users to stake their tokens and strengthen network security. Conversely, if staking is high, inflation decreases to limit value dilution, balancing security with ATOM’s value control.

Advantages of Dynamic Inflation

- Rapid Adaptation. Dynamic inflation quickly responds to market fluctuations, adjusting supply to reduce excessive volatility and stabilize token price.

- Effective Scarcity Management. By modulating supply according to network needs, this mechanism preserves token scarcity, supporting its intrinsic value.

- Confidence and Stability. The combination of burning and minting reduces extreme variations, reinforcing user trust in the project.

Disadvantages of Dynamic Inflation

- Uncertainty for Investors. Constant supply adjustments make the model less predictable for investors, complicating long-term planning strategies.

- High Supervision Requirements. The success of dynamic inflation depends on continuous monitoring of economic and market indicators, requiring significant resources to ensure efficiency.

Comparing Inflation Models

Adaptation to Project Maturity Stages

The project’s maturity stage plays a key role in selecting an inflation model:

- In early phases, variable or KPI-based inflation is often preferred to attract participants and encourage rapid adoption.

- Once the project stabilizes, more predictable models like temporal inflation can be adopted, or a supply cap can be set to enhance long-term token value.

Combined Inflation Strategies

Some projects adopt a hybrid approach by combining multiple inflation models to maximize effectiveness and address diverse objectives. This strategy leverages the unique advantages of each model while minimizing their drawbacks.

For instance, a project may define a regular token issuance schedule (temporal inflation) while adjusting issuance based on key performance indicators (KPIs) such as trading volume, participation rates, or network security.