Contents page

In the article “Airdrop : What is it ?”, we defined what an airdrop is, its objectives, formats, and challenges, illustrated by the case of Hyperliquid.

In this new article, we explore how a project selects the audience eligible for its airdrop and how this strategy affects the market and its tokenomics.

How does a project choose the eligible audience for an airdrop?

The eligible audience is defined based on the project’s objectives and its strategic intentions for the airdrop. The selection criteria vary greatly from one project to another.

Based on holding other tokens

To increase awareness and encourage adoption, a project might target holders of specific tokens or users active on certain blockchains. Distributing tokens to existing communities can help draw attention to a new project.

For example, when Tron migrated from Ethereum to its own blockchain, it distributed 30 million TRX to ether holders via an airdrop. The goal was to attract the Ethereum community’s interest ahead of the transition and bring them into its new ecosystem.

Based on user engagement

To build an active community, the project may target users who interact on social media, participate in forums, or join community groups. Sharing content, commenting, and creating original content can also be encouraged.

This type of targeting not only stimulates activity but also builds user loyalty and reinforces their sense of belonging to the project’s ecosystem.

One example is Smog Token, a meme coin on Solana, which conducted a multi-phase airdrop through the Zealy platform. Participants were asked to complete various community quests: following official social media accounts, posting positive comments on platforms like CoinMarketCap, inviting friends, or creating promotional content. Each action earned experience points (XP), which determined the portion of $SMOG tokens each participant received.

Based on participation in specific activities

To reward the most active and “early” users, tokens can be distributed to those who made transactions, tested features, or joined beta tests. Points or tier systems can be used to measure engagement and adjust reward distribution.

An example is Blur’s airdrop, an NFT marketplace, where NFT traders and creators who had published NFTs on the platform were eligible for a second airdrop. Rewards were allocated based on their level of activity, evaluated through a point system.

These three methods cover many of the commonly used approaches for airdrops, though others exist. Each project can define its own criteria based on its specific goals or innovate based on its strategy and positioning.

The impact of airdrops on tokenomics and the market

Beyond simple token distribution, airdrops have a direct impact on a project’s economy.

Distribution and dilution

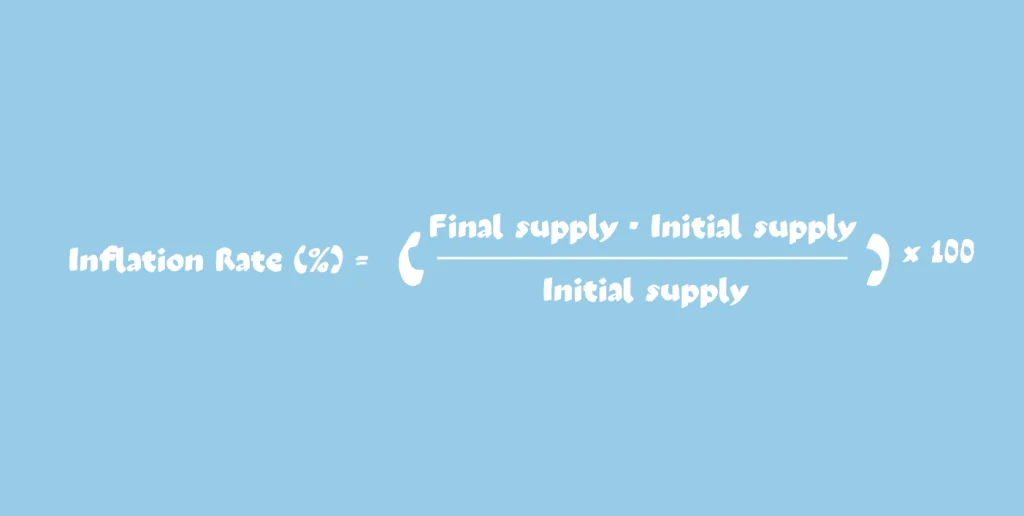

One major concern with airdrops is token dilution due to an oversupply. A massive airdrop can:

- Generate selling pressure if recipients immediately sell their tokens.

- Reduce the perceived scarcity of the token, potentially lowering its price.

To mitigate these effects, projects may implement a vesting mechanism to release tokens gradually over time, reducing short-term selling pressure.

Also, carefully determining the percentage of total token supply used for the airdrop helps control its market impact.

An airdrop representing 70% of the supply will obviously have a much larger selling impact than one representing just 0.5% of the circulating supply.

Trading volume, liquidity, and market capitalization

An airdrop can also significantly affect a token’s market dynamics. By encouraging user interaction, it boosts transaction volume. Recipients may also use the tokens to provide liquidity in pools, thereby strengthening the token’s liquidity.

In addition, the increase in circulating supply naturally introduces selling pressure. However, if the airdrop attracts new users, generates visibility, and stimulates engagement, it can also increase demand and help support or even boost the project’s market capitalization.

Still, the success of an airdrop depends heavily on the targeted audience. If the distribution mainly attracts airdrop hunters—interested more in quick profits than the project itself—it can backfire. This can result in high volatility, selling pressure, and ultimately undermine the airdrop’s original goal.

The example of Hyperliquid (HYPE) illustrates this well. On November 29, 2024, the protocol launched a massive airdrop of 310 million HYPE tokens, 31% of its total supply. The campaign increased trading volume and improved pool liquidity as users were incentivized to engage with the ecosystem. The token’s price jumped from $3.57 to $33.68 in less than a month, and its valuation soared. This shows that a well-structured airdrop can boost visibility, platform activity, and project valuation simultaneously.

Key takeaways

- The choice of the eligible audience depends on the project’s objectives: holders of other tokens, community engagement, or participation in specific activities.

- Airdrops directly affect tokenomics and the market: dilution, selling pressure, and circulating supply management.

- Airdrops can increase trading volume, improve liquidity, and support market capitalization.

- A poorly targeted or poorly planned airdrop can lead to excessive volatility and weaken the project’s economy.

Learning a lot here