Contents page

Inflation is a fundamental concept in economics, and its importance is equally essential in tokenomics, the economics of tokens.

What is inflation in tokenomics?

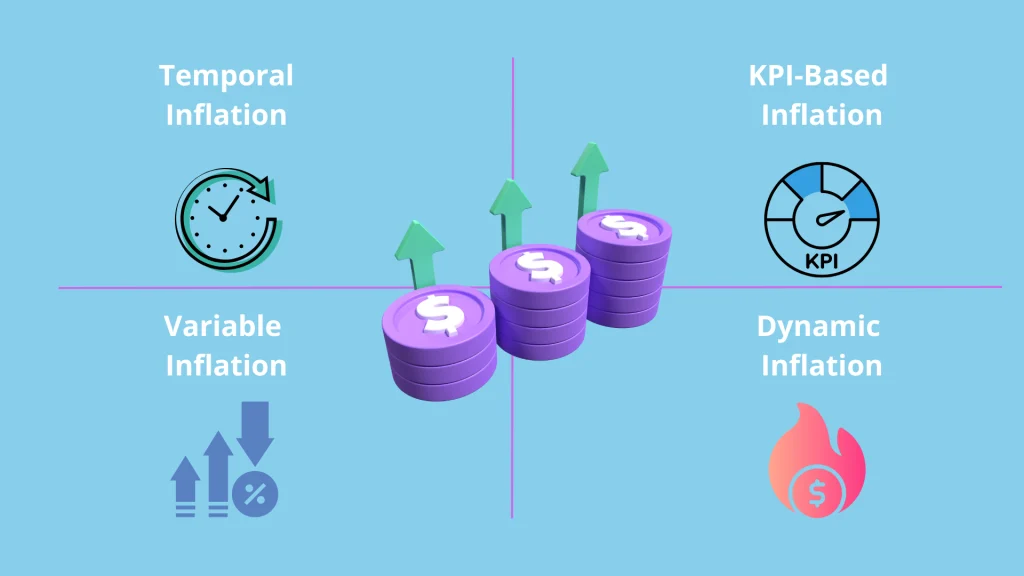

Inflation in tokenomics refers to the increase in the number of tokens available on the market over a given period. This increase can result from various mechanisms, such as the issuance of new tokens, staking rewards, or mining rewards.

Unlike inflation in traditional finance, which is typically influenced by political decisions or central banks, inflation in tokenomics is often pre-programmed into smart contracts. This ensures complete transparency and allows for anticipating its effects.

Although inflation is essential in tokenomics for fostering growth, ensuring the smooth functioning of the ecosystem, supporting liquidity, and encouraging participation, poor management can lead to value dilution and an imbalance between supply and demand, thereby jeopardizing the project’s viability.

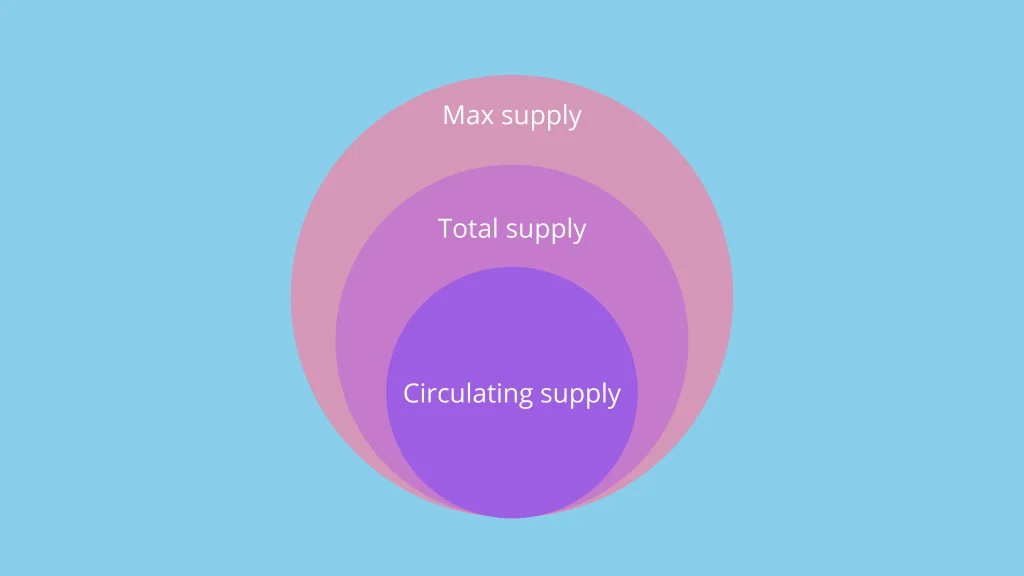

How to measure inflation of a token?

The inflation of a token is calculated by evaluating the evolution of its total supply over a given period.

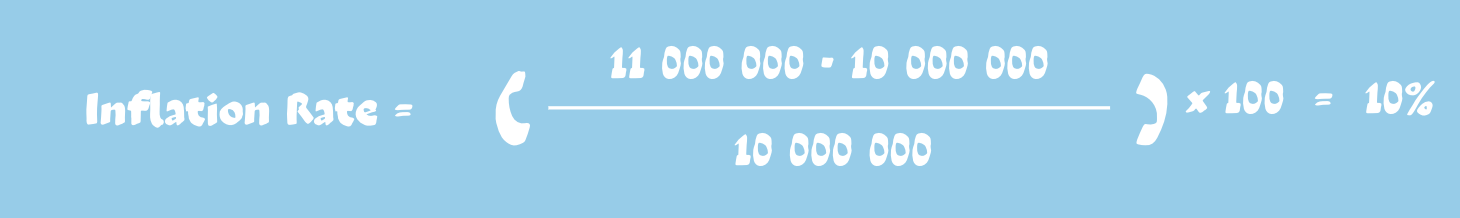

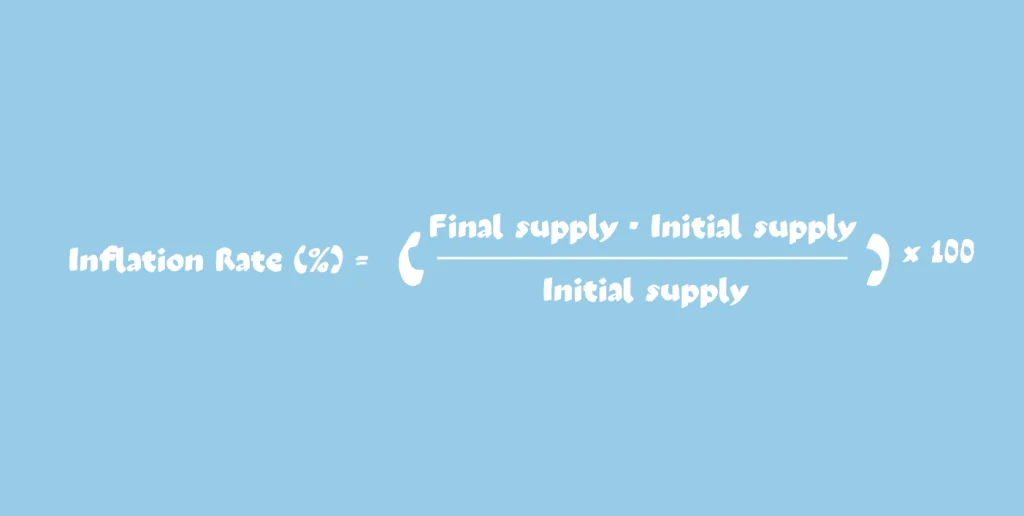

Inflation rate formula:

- Initial supply: Number of tokens available at the beginning of the period.

- Final supply: Number of tokens available at the end of the period.

Example: If a token has an initial supply of 10,000,000 tokens at the start of the year and this supply reaches 11,000,000 tokens by the end of the year, this means the token experienced 10% inflation over the year.

Why is inflation essential in tokenomics?

Inflation directly impacts the value and scarcity of a token, making it a key indicator for understanding the economic dynamics of a token.

Stimulating participation and liquidity

Inflation helps stimulate the ecosystem of a project. Many projects use inflation as a lever to encourage active user participation. This is particularly the case through mechanisms such as staking or mining, which distribute new tokens in exchange for securing or contributing to the network.

These incentives help:

- Strengthen adoption: Users are motivated to join and actively participate in the ecosystem.

- Improve network security: Increased participation through staking or mining reduces the risk of attacks.

- Ensure liquidity: Newly issued tokens support market trading.

In the early stages of a project, well-calibrated inflation can also play a crucial role. It helps attract early users with attractive rewards, thus fostering growth and expansion of the ecosystem.

Impacting scarcity and value

Inflation directly affects the scarcity of a token, a key factor in its valuation.

Specific mechanisms, such as halving (periodic reduction of rewards) or burning (intentional destruction of tokens), can be implemented to limit inflationary effects. These mechanisms help maintain or increase the scarcity of a token, stimulating demand and increasing its value.

Controlled inflation helps strike a balance between issuing enough tokens to support the economic activity of the network and preserving their long-term value.

Challenges and risks of inflation in tokenomics

Despite its advantages, inflation carries significant risks that, if not anticipated, can compromise the success of a project.

Value dilution and supply-demand imbalance

Excessive inflation leads to a dilution of the token’s value, reducing each holder’s relative share of the total supply. This dilution weakens perceived scarcity, a key factor in valuation. If the issuance of new tokens exceeds demand, their price mechanically drops, creating downward pressure on the market.

Impact on users, investors, and project credibility

Poorly managed inflation can disrupt the balance between incentives and long-term value. When excessive, it tends to discourage investors and users as it causes a rapid dilution of token value and reduces the overall attractiveness of the project.

Conversely, insufficient inflation may limit the incentives offered to users, which hampers their engagement and restricts growth and adoption of the network.

Finding the balance for sustainable success

To maximize the benefits of inflation while minimizing its risks, prudent management is essential. This involves:

- Adjusting inflation rates to strategic goals and project maturity.

- Implementing mechanisms to regulate inflation, such as halving or burning.

- Ensuring complete transparency to maintain investor confidence.

The example of inflation in Polkadot (DOT)

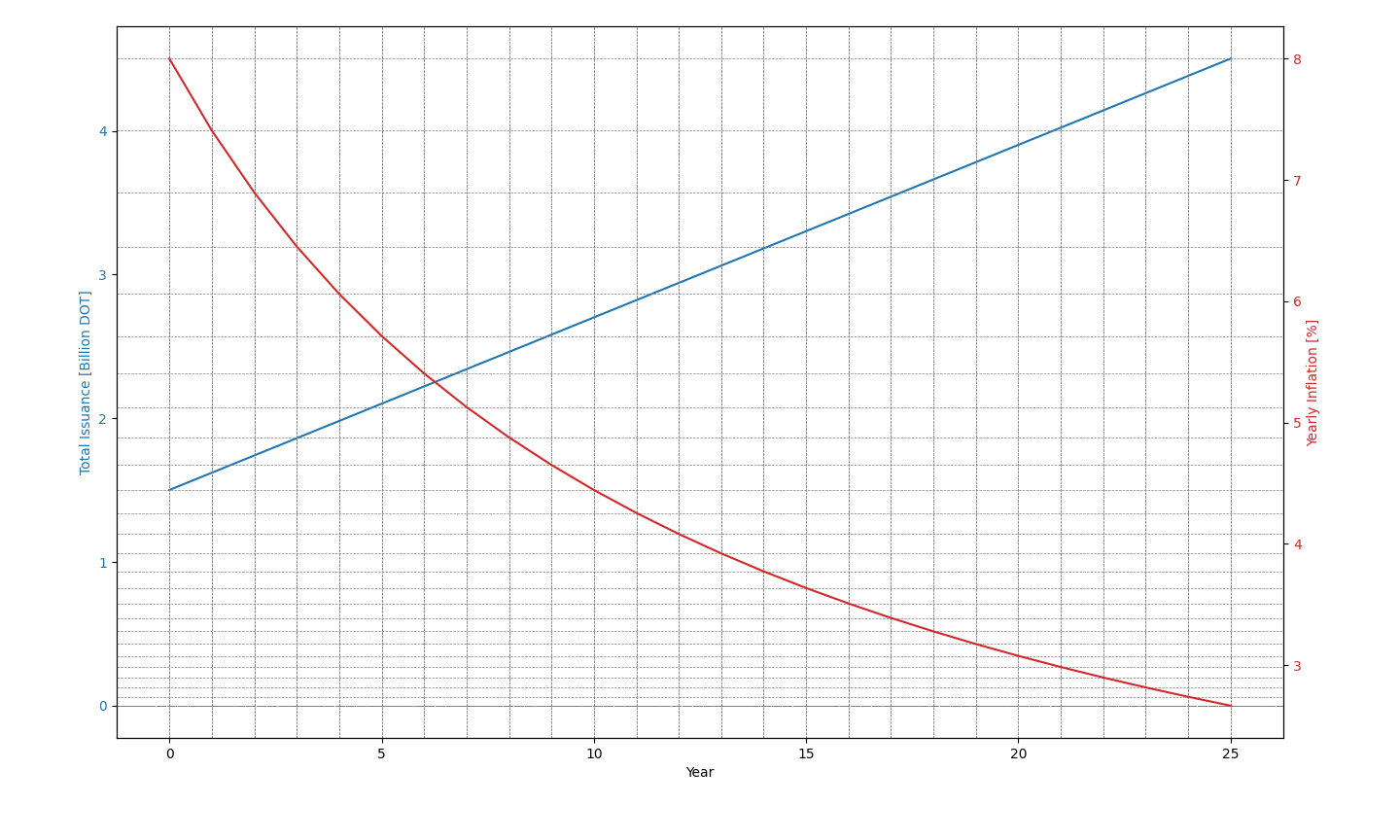

Polkadot (DOT) illustrates structured and transparent management of the inflation of its DOT token. The network adopts a linear growth model for its supply, with a fixed issuance of 120 million DOT per year.

Of this issuance, 85% is allocated to participants in the Nominated Proof of Stake (NPoS) consensus mechanism, while 15% is allocated to the on-chain treasury. This treasury aims to fund projects and initiatives designed to strengthen and develop the Polkadot ecosystem.

This gross inflation model guarantees attractive incentives for stakers, encouraging their active participation and thus increasing network security. It also reflects a balanced approach between rewarding participants and funding innovation, contributing to the economic sustainability of the Polkadot ecosystem.

A 25-year forecast, provided by Polkadot, highlights a gradual decrease in the annual gross inflation of DOT.

The 25-year forecast curve clearly illustrates the dynamics of this model. Although the annual gross issuance remains constant at 120 million DOT, the annual gross inflation rate, expressed as a percentage, gradually decreases. This decline is due to the dilution effect: as the total supply of DOT increases, the relative share of new tokens issued each year decreases. This ensures controlled inflationary pressure in the long term.

Thus, the blue curve in the image shows a linear increase in the total supply of tokens, while the red curve highlights an exponential decrease in the gross annual inflation rate.

Key Takeaways

- Inflation refers to the increase in the supply of tokens.

- It stimulates participation, strengthens network security, and supports growth.

- Poor management dilutes the value of tokens and harms user confidence.

- Finding the balance is crucial for ensuring the long-term viability and success of the project.

[…] how tokens are distributed, used, and managed, is equally important. Poorly designed tokenomics can lead to inflation, a lack of incentive alignment, or price manipulation. A strong project will have a fair […]