Contents page

Buyback and burn is a strategy frequently used in tokenomics. It involves a project buying back its own tokens from the market and then destroying them to reduce the circulating supply.

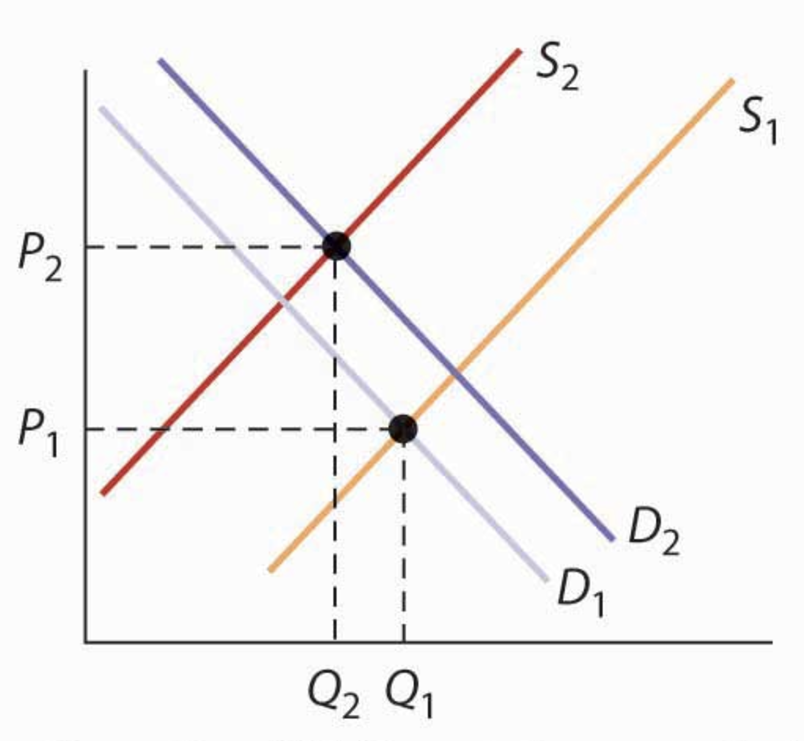

This mechanism relies on the law of supply and demand. By reducing supply, token prices can potentially increase, as illustrated in the graph below.

For more information, read our article: Buyback and burn: What is it ?

However, despite its widespread use, this approach has several limitations:

- Lack of intrinsic value creation

- Risk of manipulation

- Potential liquidity issues

- Limited long-term impact

These limitations have led to the emergence of alternatives designed to address these issues, as well as complementary mechanisms.

Alternative 1: Buyback and make

Buyback and make is an innovative alternative to the classic buyback and burn model. Instead of destroying the repurchased tokens, they are reinjected into the ecosystem to fund strategic initiatives, stimulate adoption, and create long-term value.

This approach transforms a destruction mechanism into a driver of sustainable growth, fully leveraging the potential of the tokens.

The emergence of this alternative answers a fundamental question: why destroy something of value when it could be used to develop the ecosystem and strengthen user engagement?

How buyback and make works

- Token buyback

The project buys back its tokens from the market using a portion of its revenue or reserves. Depending on the project’s goals, this buyback can be periodic, regular, automated, or manual. - Token reutilization

The tokens can either be used immediately for strategic actions or temporarily stored in a treasury for reinvestment as needed.

The repurchased tokens are used to:

- Reward users by redistributing tokens to encourage engagement, loyalty, and ecosystem participation.

- Fund new projects, such as developing innovative products or services.

- Incentivize contributors by encouraging developers or creators to enhance the ecosystem.

- Improve liquidity by injecting them into liquidity pools to stabilize trading and reduce volatility.

Benefits of buyback and make

- Circular economy: Repurchased tokens are reused to strengthen the ecosystem, creating a sustainable value cycle.

- Growth stimulation: This strategy supports initiatives that drive innovation and long-term adoption.

- Enhanced engagement: By offering incentives, buyback and make fosters active user participation and strengthens their involvement in the project.

- Value reinforcement: Instead of artificially reducing supply, this alternative increases demand organically by multiplying token use cases.

- Improved liquidity: By injecting repurchased tokens into liquidity pools, the project stabilizes the market, reduces volatility, and facilitates exchanges for all users.

Example: Nexo

Nexo exemplifies the buyback and make approach with its $NEXO token. The repurchased tokens are placed in a dedicated reserve (Investor Protection Reserve), where they are later reused to pay interest, support liquidity, and retain users.

All buybacks are transparent and subject to a 12-month lock-up period before utilization.

Alternative 2 of buyback and burn : Staking programs

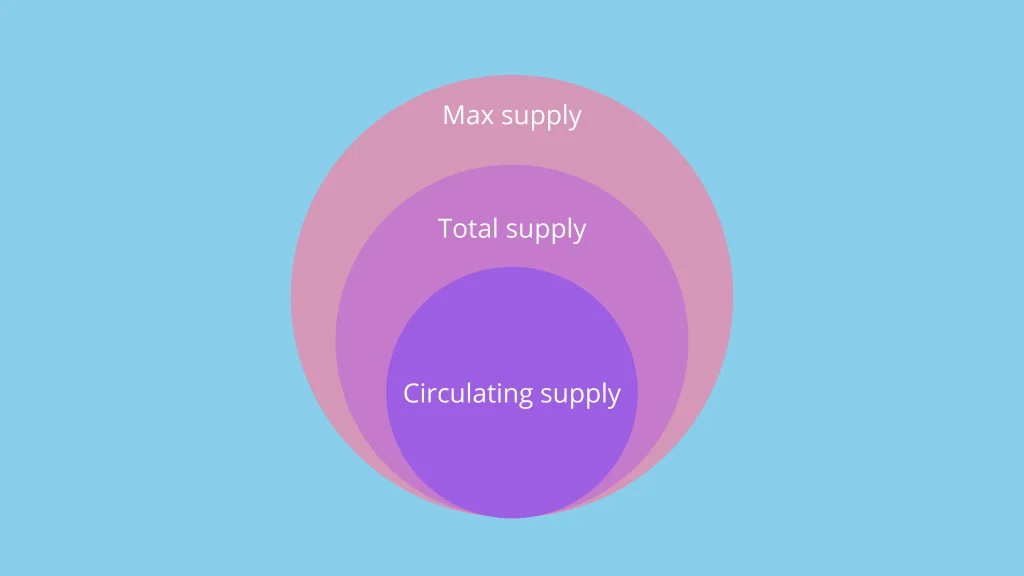

Staking is a mechanism that temporarily removes tokens from circulation without destroying them. Token holders lock their tokens in a smart contract in exchange for rewards.

While staking does not directly replace buyback and burn, it serves as a strategic complement to other mechanisms like buyback and make.

How staking works

- Token lock-up

Users lock their tokens in a smart contract for a specified duration. - Receiving rewards

In return, users earn additional tokens or interest, incentivizing long-term token holding.

Benefits of staking

- Price stability or growth: Temporarily removing tokens from circulation creates scarcity, supporting market stability and potential price increases.

- Reduction without destruction: Unlike burning, staking retains tokens for future reintegration.

- Long-term engagement: Staking encourages users to hold their tokens over time.

- Active participation: In Proof-of-Stake networks, stakers also help secure the network.

- Inflation control: Staking limits inflation by reducing the available token supply. Additionally, by regulating token issuance through rewards and encouraging users to restake, it mitigates the impact of new token creation.

Example: Ethereum 2.0 (ETH)

Ethereum 2.0 is a prime example of the benefits of staking as a complement to buyback and burn or other alternative mechanisms. As of this writing, around 28% of the total ETH supply is staked. This reduces the circulating supply and creates relative scarcity, which supports token prices.

Stakers also contribute to network security while earning rewards, reinforcing their long-term commitment.

Key takeaways

- Buyback and burn: The project buys back tokens from the market and permanently destroys them to reduce circulating supply and create artificial scarcity.

- Buyback and make: The project buys back tokens from the market to actively reinvest them into the ecosystem and support specific initiatives.

- Staking: Users lock their tokens in the protocol to earn rewards while temporarily reducing the circulating supply.