Contents page

The buyback and burn is a common strategy in tokenomics. This mechanism combines two main actions: buying back tokens and destroying them. The primary goal of this approach is to reduce the total supply of tokens in circulation, thereby creating scarcity. This reduction in supply aims to support the value of the remaining tokens.

How does buyback and burn work?

The process involves two main steps:

1. Buying back tokens

The project uses a portion of its profits or reserves to buy back its own tokens on the market.

2. Burning tokens

After purchasing these tokens, the project sends them to a “burn address.” This address, which lacks a private key, renders these tokens inaccessible. As a result, the tokens are permanently removed from circulation.

An example of a burn address on the BNB Smart Chain (BSC) is the so-called “blackhole” address:

0x000000000000000000000000000000000000dEaD.

This address ensures that tokens sent to it can never be retrieved. They are permanently removed from the BNB Smart Chain ecosystem.

What is the purpose of buyback and burn?

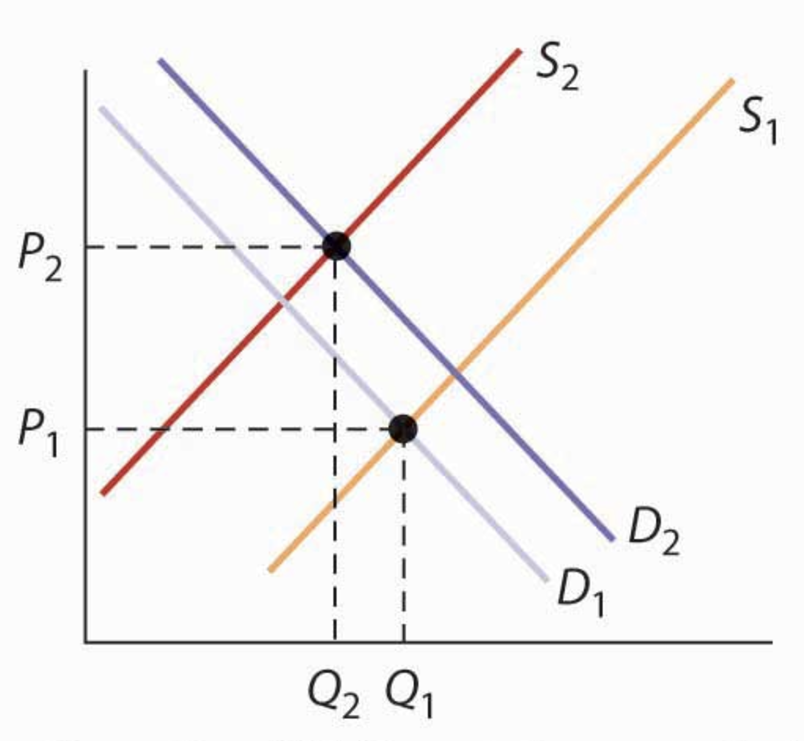

The buyback and burn reduces the total supply of tokens in circulation, creating upward pressure on their value, provided demand remains constant or increases. This mechanism relies on the classic law of supply and demand: the fewer tokens available, the higher their potential value.

As illustrated in the graph above, a decrease in quantity (Q2 < Q1, where Q represents quantity) leads to an increase in price (P2 > P1, where P represents price).

Origins of buyback and burn

Inspired by traditional finance

The concept of buyback originates from traditional finance, where publicly traded companies repurchase their own shares on the market. This strategy aims to:

- Reduce the number of shares in circulation to increase the value of remaining shares.

- Stabilize the price during periods of declining or stagnant demand.

- Send a signal of confidence to investors.

By optimizing their financial structure and supporting the value of their shares, companies enhance their attractiveness to investors.

Adaptation to tokenomics

In tokenomics, this strategy has been adopted and transformed under the name “buyback and burn”. Unlike traditional finance, where repurchased shares can be held, tokens bought back in a buyback and burn are destroyed.

Why use a buyback and burn?

Supporting token value

By reducing the total supply, the buyback and burn favors the appreciation of remaining tokens. This mechanism can benefit current investors while attracting new participants due to the potential increase in token value.

Strengthening investor confidence

Buyback and burn is a strong signal to investors. It demonstrates the project’s commitment to supporting token value and ensuring the ecosystem’s long-term viability. The transparency offered by blockchains reinforces this confidence: every burn transaction is public, traceable, and irreversible.

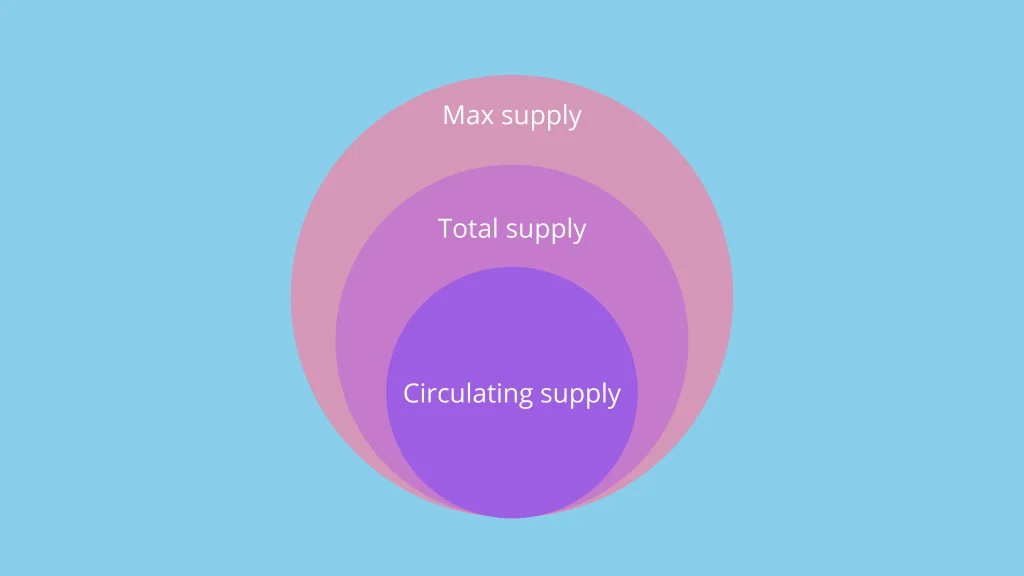

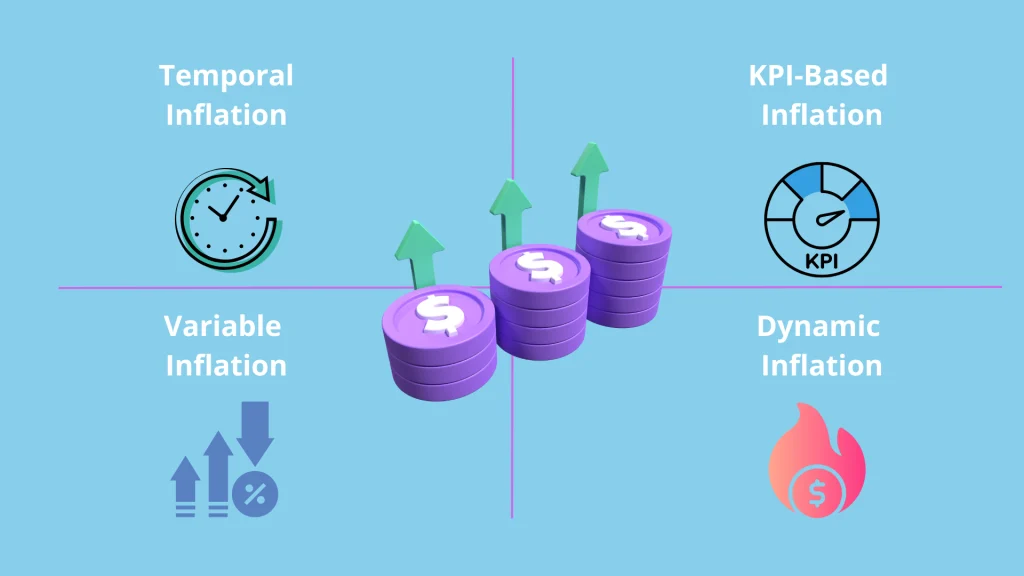

Controlling token inflation

In projects where new tokens are regularly issued, especially in inflationary models, the buyback and burn plays a crucial role in limiting inflation. By destroying a portion of tokens in circulation, this mechanism offsets continuous issuance and can stabilize or even reduce the overall supply in the long term. This helps protect the value of remaining tokens while avoiding excessive dilution.

Types of buyback and burn

The buyback and burn can be triggered either manually or automatically, depending on the mechanisms defined by the project:

- Manual trigger: Decisions are made by the team or a DAO, offering greater flexibility to adapt to market conditions.

- Automatic trigger: Smart contracts execute the buyback and burn based on preprogrammed rules.

The process can rely on various predefined criteria:

- Regular intervals: For example, every six months, providing predictability for stakeholders.

- Profit thresholds: A percentage of generated revenue is dedicated to buying back and burning tokens, aligning the mechanism with the project’s financial success.

- Specific events: Such as reaching a user milestone or completing a key development phase.

Example: Binance and the buyback and burn of its BNB

Binance was one of the pioneers in integrating a buyback and burn mechanism into its tokenomics. Indeed, between 2017 and 2021, the platform used a portion of its profits to buy back BNB tokens from the market in order to destroy them.

Since late 2021, the project has evolved and no longer utilizes the buyback and burn model, replacing it with an Auto-Burn system. This quarterly mechanism automates token destruction by adjusting the amount based on two criteria: the price of BNB and the number of blocks generated on the BNB Smart Chain (BSC).

Despite this change, the ultimate goal remains the same. To reduce the total supply from 200 million BNB to 100 million, representing a 50% reduction. This scheduled destruction process aims to increase BNB’s scarcity and support its value over the long term.

Limits of buyback and burn

No creation of intrinsic value

While reducing supply can temporarily increase token value, it does not improve the project’s fundamentals. This mechanism neither generates innovation, significant adoption, nor additional utility for the token. Therefore, it can create an illusion of value without real impact on the ecosystem.

Risk of manipulation

If buyback and burn lacks transparency, it can be opportunistically used to manipulate token prices. Some projects may repurchase tokens at strategic moments to create a false perception of scarcity or high demand, misleading investors.

Liquidity issues

A significant reduction in the circulating token supply through buyback and burn can impact market liquidity. This makes transactions more volatile and deters investors and users seeking long-term stability, making the token less attractive and riskier.

Uncertain long-term effects

If token demand is not supported by strong fundamentals, the positive impact of burns may diminish over time. Without growing adoption or robust use cases, supply reduction alone is insufficient to guarantee sustainable value growth.

Key takeaways

- A mechanism combining the repurchase and destruction of tokens to reduce circulating supply, aiming to increase scarcity and value.

- The goal is to support token value, strengthen investor confidence, and control inflation.

- Binance (BNB) uses quarterly buybacks and burns to reduce total supply.

- However, the limitations of buyback and burn include the lack of intrinsic value creation, reduced liquidity, and potential for manipulation if the process is not transparent.

[…] buybacks signal project confidence while burns introduce enforced scarcity. As noted by tokenomics-learning.com, this can generate upward pressure on value if demand remains constant or increases. However, as […]

Great Information and the explanation was very helpful and informative.