Contents page

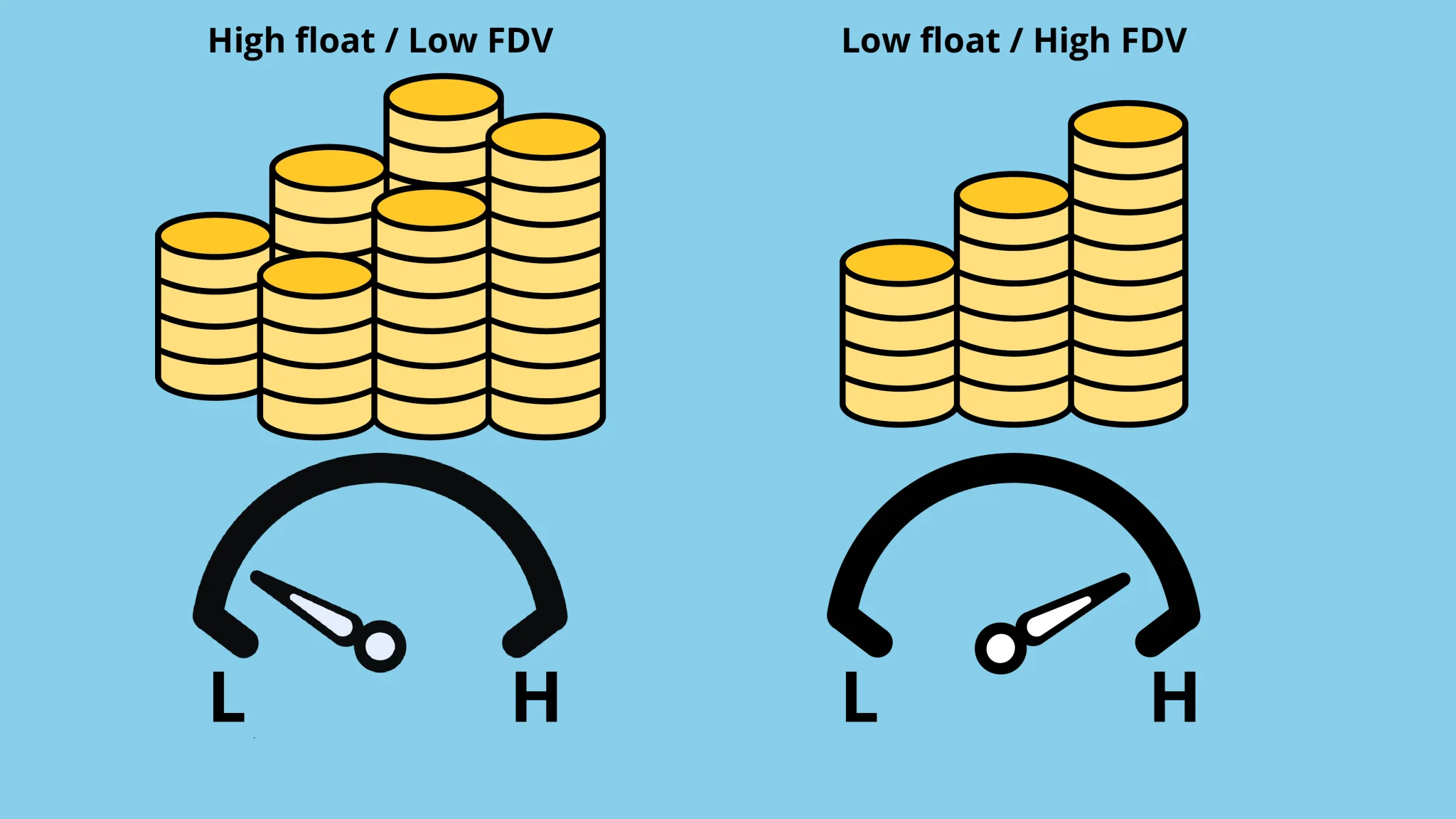

When launching a token (TGE), a Web3 project can adopt various strategies. These strategies are defined by two variables within the tokenomics model: the float and the Fully Diluted Valuation (FDV). These two parameters lead to two primary models: high float / low FDV and low float / high FDV.

In the high float / low FDV model, a large portion of tokens is made available at launch. This setup typically results in a lower FDV, as a significant number of tokens in circulation tends to dilute the perceived valuation. Conversely, in the low float / high FDV model, only a limited quantity of tokens is introduced to the market. This creates a higher FDV due to the scarcity of available tokens.

The strategic choice between these two models directly impacts the perception and performance of a token at its launch. Float and FDV not only determine the availability of tokens on the market but also their long-term valuation potential. These elements play an essential role in shaping the market dynamics in the short and medium term.

What is the float?

The float represents the number of tokens available on the market for trading. It directly affects the initial liquidity of a token, meaning how easily tokens can be bought or sold. There are two possible float configurations that impact the project’s liquidity.

Low float

A low float means only a limited number of tokens are put into circulation at launch.

This strategy creates artificial scarcity, where demand outstrips supply. Additionally, a low float restricts liquidity, so buyers compete for a limited number of tokens. This situation can lead to rapid price increases and high volatility.

High float

A high float means a large number of tokens is available from the start.

This improves liquidity and generally stabilizes prices in the short term. A larger supply better meets demand, but if demand doesn’t absorb the full supply, the token price might drop. This may limit the token’s potential for appreciation.

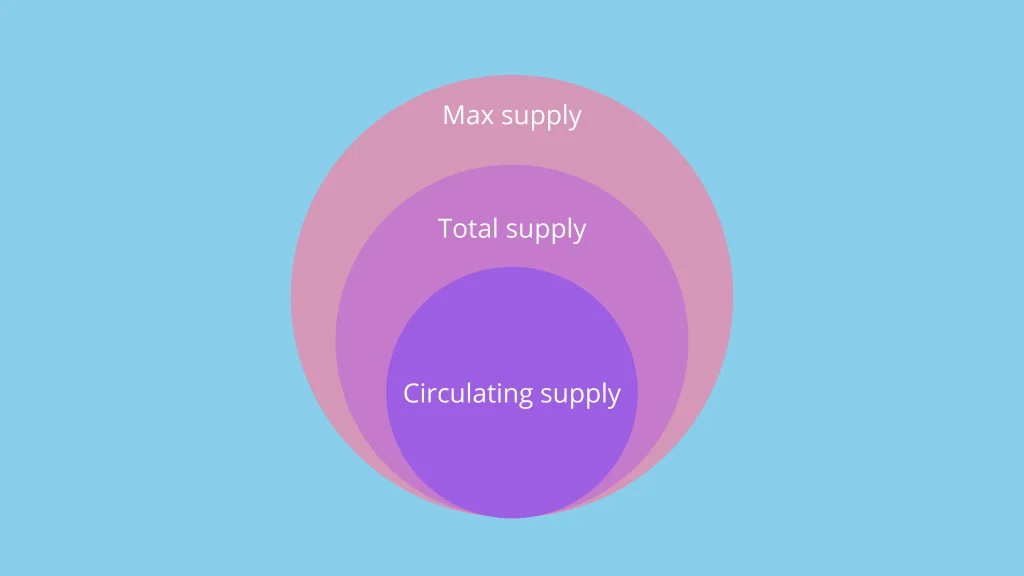

What is Fully Diluted Valuation (FDV)?

FDV represents the total valuation of a project. It’s an estimate of market capitalization if all planned tokens were already in circulation.

FDV is calculated by multiplying the current token price by the maximum supply.

![]()

Low FDV

A low FDV represents a cautious valuation at a token’s launch.

It often reflects a realistic approach from founders, aligning the project’s valuation with its current development stage. Valuation thus adjusts gradually based on real growth, avoiding disappointing investors and users if future performance doesn’t meet expectations.

High FDV

A high FDV, on the other hand, represents an ambitious project valuation. It may indicate high aspirations and substantial long-term growth potential, even if many tokens are still locked.

However, this can also raise concerns about potential overvaluation. When these tokens unlock and enter the market, it could trigger significant volatility.

Different token launch models: High float / Low FDV or Low float / High FDV?

High float / low FDV

At token launch, when the float is high, a large portion of tokens is put into circulation. Although this doesn’t directly affect the FDV, a high float can exert downward pressure on the token price. An abundant supply coupled with initial low demand tends to stabilize or lower the price due to unabsorbed excess supply.

Thus, a “high float / low FDV” model forms due to the float’s impact on price, which in turn influences the FDV calculation.

With a fixed maximum supply, if the token price is low due to a high float, FDV tends to be low.

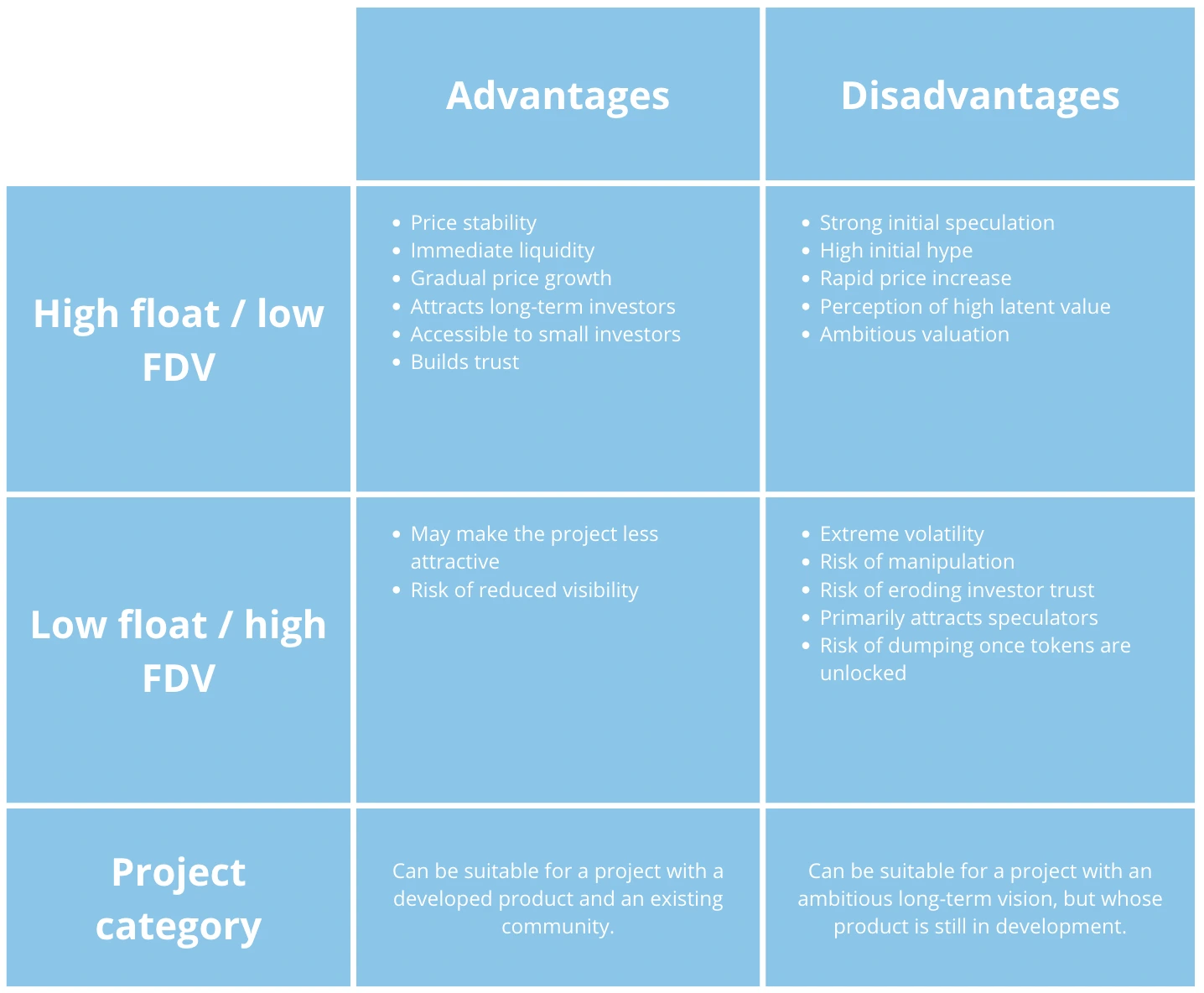

Advantages of high float / low FDV model

- Price stability. With high liquidity from a large number of circulating tokens, volatility and price fluctuations are reduced, creating a safer environment for investors and users, allowing for gradual growth as the project gains community traction.

- Accessibility. This model allows small investors easier access to tokens at affordable prices before demand rises and prices reflect higher valuation.

- Reduced speculation and long-term investors. This approach is less appealing to short-term speculators seeking quick profits, instead attracting long-term investors confident in the project. Additionally, a low FDV may suggest an undervalued project at an attractive price, appealing to investors seeking stability and gradual growth.

- Initial liquidity. A large number of circulating tokens ensures good liquidity, facilitating trades and limiting sudden price changes.

- Increased trust. A fair project valuation avoids the traps of overvaluation driven by artificial scarcity and hype, strengthening trust within the community and among stakeholders.

Disadvantages of high float / low FDV model

- Less initial hype. Unlike scarcity-driven models (low float), this model does not generate significant initial excitement due to low supply incentives, which may limit investor enthusiasm and reduce quick profit prospects.

- Limited growth potential. A low FDV may give the impression that the project lacks ambition or attractiveness to investors.

- Risk of insufficient interest. While projects generally aim to deter quick-profit-seeking investors who may cause short-term volatility and long-term degradation, reduced volatility carries the risk of not sparking enough short-term interest, potentially slowing growth.

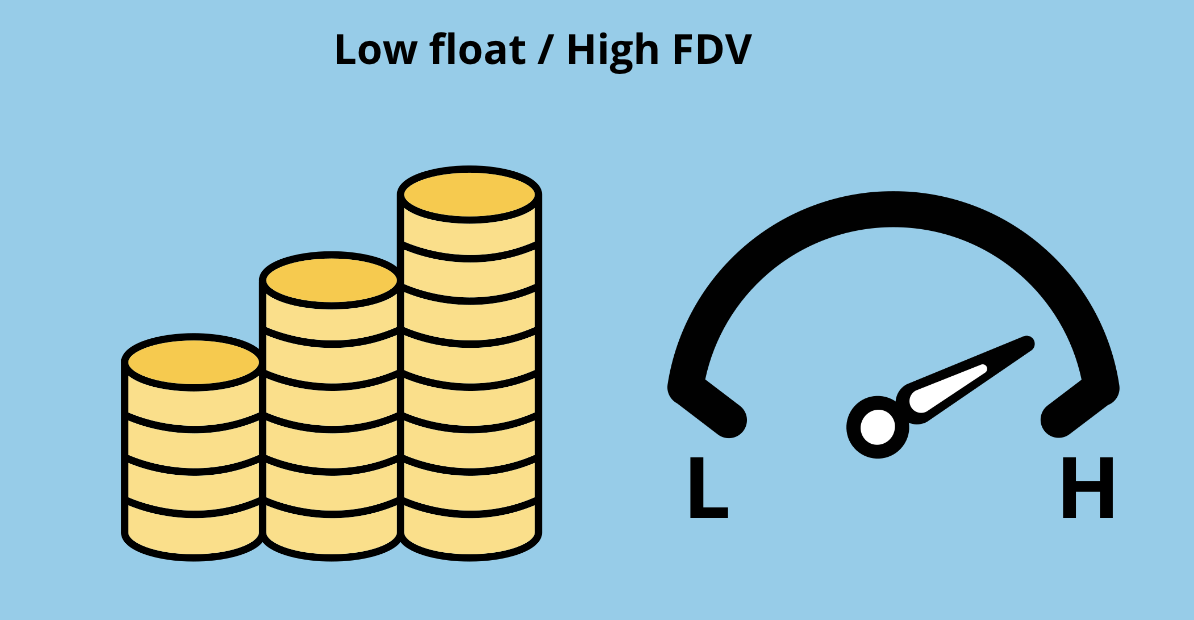

Low float / high FDV

When launching a token with a small portion of tokens in circulation (low float), a low float / high FDV model tends to form. Similar to the high float / low FDV model, this is due to how FDV is calculated.

Low liquidity creates artificial scarcity, putting upward pressure on the token price. When token supply is limited, tokens become harder to acquire, leading to competition among buyers and driving up token prices.

Therefore, the circulating token quantity doesn’t directly impact FDV. However, a low float can drive up prices, resulting in a higher FDV. This forms a low float / high FDV model.

Advantages of low float / high FDV model

- Scarcity effect and price increase. By limiting the short-term supply (low float), the project creates artificial scarcity, driving competition for tokens and pushing prices higher.

- Scarcity effect and hype. A low float combined with a high FDV can generate excitement around the token launch and, consequently, strong initial demand. Investors are drawn to scarcity and the promise of future high valuation due to the project’s ambition, fueling token price speculation.

- High short-term gains potential. The earlier investors or users buy, the more they can benefit from a rapid price increase due to initial token scarcity. This low float / high FDV model can lead to a high short-term return on investment (ROI), encouraging token purchases and attracting investors to the project at the opportune time.

Disadvantages of low float / high FDV model

- High volatility. With limited supply, prices may fluctuate extremely and suddenly in the short term.

- Dumping risk. When locked tokens eventually unlock, early buyers often sell en masse for profits, causing a sharp price drop.

- Potential manipulation. Limited initial circulation allows large token holders to easily manipulate market prices, which can be disadvantageous for small investors and project users.

- Short-term investors. The low float / high FDV model particularly attracts short-term investors or speculators, as initial token scarcity can lead to a quick price surge. These investors benefit from the project launch without genuine interest in it, creating positive short-term effects but potentially negative long-term impacts on project viability.

Key takeaways on tokenomics and token launch strategies

The two models, high float / low FDV and low float / high FDV, represent very different launch strategies. Each has its advantages and risks, influencing investor perception and market behavior. The model choice depends on the project’s objectives, vision, and strategy.