Contents page

A bonding curve is a mathematical formula used by Web3 projects to adjust token prices based on supply and demand. Integrated into the token’s smart contract, this function increases token prices when they are bought and decreases them when they are sold.

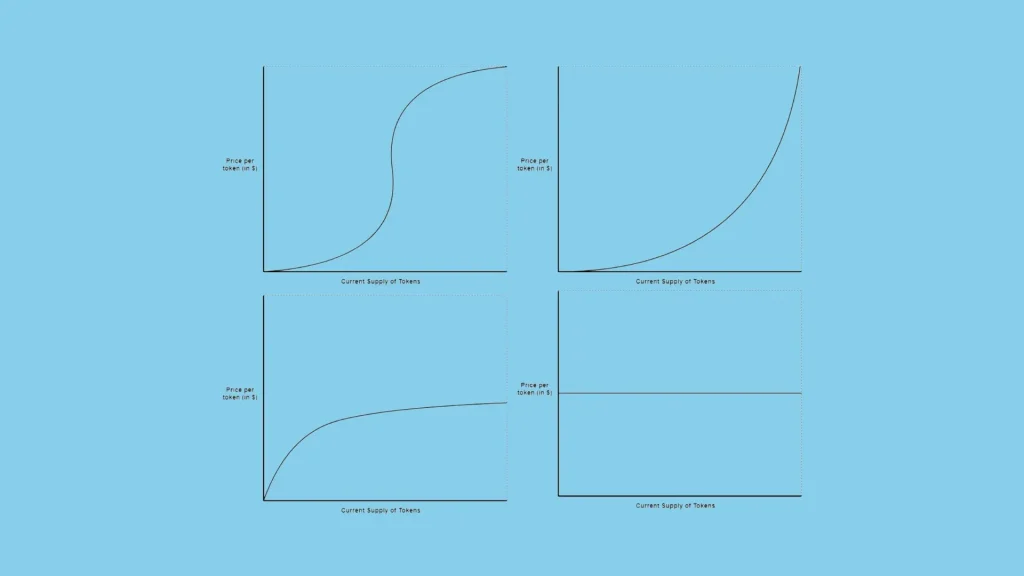

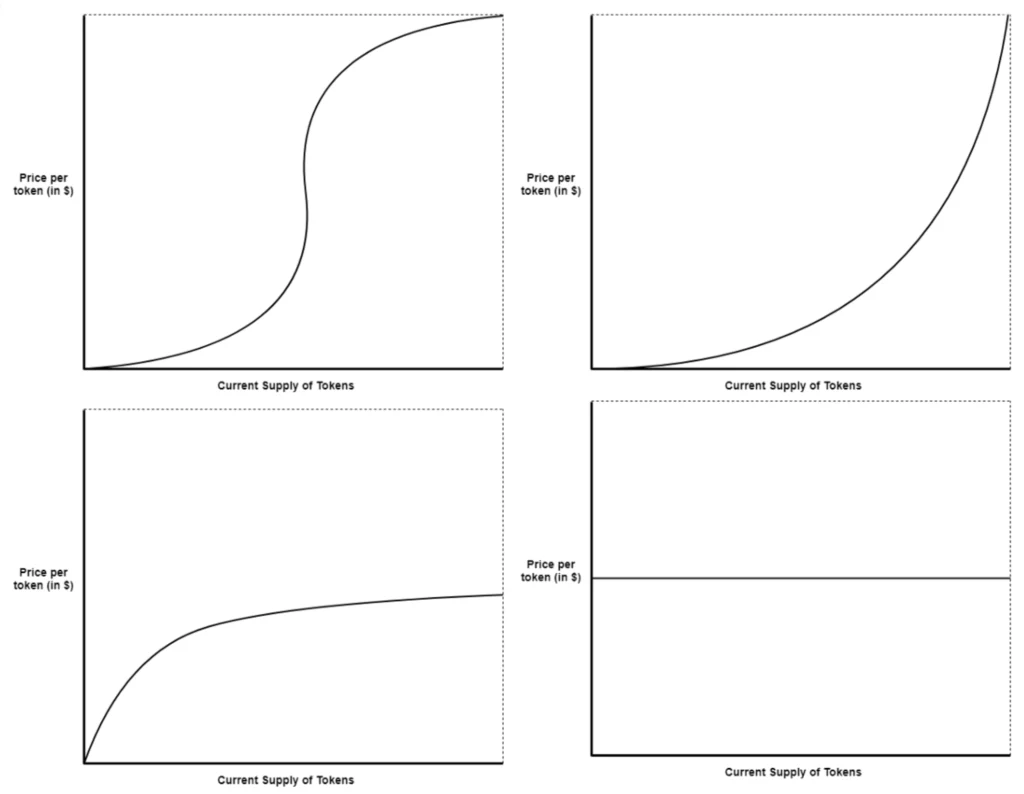

There are various types of bonding curves, allowing for the creation of tokenomics models tailored to the project’s needs and goals. Among these types are linear curves, sigmoid curves, quadratic curves, or negative exponential curves. These are illustrated by the image below.

🔎 Learn more about the bonding curve mechanism: Bonding curves in tokenomics

Why are bonding curves important in tokenomics, and what are their advantages?

Bonding curves offer an innovative alternative to traditional economic models and solve many associated issues. Let’s explore the advantages that bonding curves bring to the tokenomics of Web3 projects.

Dynamic, predictable, and transparent pricing

Bonding curves dynamically calculate token prices with a mathematical formula accessible to everyone. They make the process transparent and predefined. This transparency allows users to predict price movements based on supply and demand. This eliminates speculation on price fluctuations.

Users can make more informed buying and selling decisions thanks to the predictability of prices, boosting their confidence. Additionally, this transparency encourages long-term engagement by enabling users to anticipate the evolution of their investments.

Elimination of human bias and manipulation

Bonding curves, through an algorithmic formula, eliminate human bias and price manipulation. They automatically adjust the token supply according to project activity, matching the real needs of the market without manual intervention.

This ensures fair token valuation for all participants and dynamic market balancing. The market self-corrects in real time, adjusting prices based on the current value of tokens driven by active user participation. This mechanism is essential for early-stage projects experiencing rapid changes in their user base and needs.

Constant and automatic liquidity

Unlike traditional systems, bonding curves allow tokens to be bought or sold directly via the smart contract, ensuring liquidity is always available.

When a user buys tokens via a bonding curve, new tokens are created and added to the total supply. Conversely, when a user sells tokens, they are destroyed and removed from circulation. This automatic process ensures constant liquidity, allowing tokens to be bought or sold at any time. Users, therefore, don’t have to worry about potential liquidity issues. Moreover, it reduces waiting times and makes the project more attractive.

Additionally, liquidity management is often complex and costly for a blockchain project, requiring significant reserves to avoid excessive price fluctuations. Bonding curves automate this process, allowing projects to focus on their development and growth.

By integrating a bonding curve, a Web3 project can also generate its own liquidity without relying on external exchange platforms, reducing associated fees and offering more direct control over the project’s market conditions.

Initial liquidity ensured

A large amount of initial liquidity is not required for blockchain projects using bonding curves. Unlike liquidity pool models, where significant liquidity is needed upfront to ensure smooth transactions and stabilize token prices, bonding curves create liquidity automatically based on demand through the mint and burn system. This eliminates an entry barrier, allowing projects with limited resources to launch more easily.

Equity and accessibility

With a bonding curve, all participants have equal access to tokens under fair conditions. Bonding curves ensure that prices reflect only supply and demand, without external intervention. Unlike some projects that offer presale phases with privileged access to tokens at reduced prices, bonding curves allow all participants to benefit from the same purchase conditions from the start, ensuring fair token distribution.

For new users, understanding token pricing can be intimidating. The clarity of bonding curves simplifies this entry barrier, enabling more people to participate by understanding the risks and costs.

Modulation of speculation and creation of scarcity

Bonding curves moderate speculative movements through their structure. When a purchase is made, the token price increases according to the predefined curve, discouraging excessive speculative behavior by making each purchase progressively more expensive. This avoids rapid and unpredictable price fluctuations, stabilizing the market.

Unlike many token models that have a max supply to create scarcity and potentially value, bonding curves generate scarcity without setting a maximum number of tokens. This system aims to maintain a balance between supply and demand, stabilizing the token’s price.

Incentives for early adopters and community engagement

Bonding curves allow early users to buy tokens at a relatively low initial price, encouraging them to support the project from the start. As demand increases, the token price rises according to the defined curve, creating attractive incentives for early and active participation.

This creates a positive feedback loop, encouraging users to invest more, thereby increasing the token’s value. Consequently, by leveraging a bonding curve, token creators can stimulate demand and increase their tokens’ value.

Moreover, this helps build a solid and diverse user base. These mechanisms also encourage community participation, as token holders can directly impact the token’s value and growth trajectory.

Decentralized financing

Bonding curves are implemented via smart contracts, allowing for automatic and intermediary-free financing. The funds collected are directly locked in the smart contract, ensuring transparent and secure resource management.

By raising funds directly from users without needing to go through platforms, projects can reduce associated fees and delays.

Reduction of slippage and fees

Slippage is the difference between the expected price of a transaction and the actual price at which it is executed. In traditional markets and some decentralized systems, slippage can be significant, especially during large transactions.

With bonding curves and their transparent and predefined mathematical formula, users can precisely predict the impact of their transactions on the price, reducing surprises and slippage.

Key takeaways on the advantages of bonding curves in tokenomics

In summary, bonding curves offer an innovative and flexible mechanism for liquidity management, price determination, and decentralized financing. They promote transparency, equity, and accessibility. By adopting bonding curves, Web3 projects can optimize their economic model, strengthen user trust, and support sustainable growth.

Advantages to remember for a tokenomics using bonding curves:

- Dynamic, predictable, and transparent pricing that adjusts to the project’s real activity, enabling users to make more informed purchase and sale decisions.

- Encourages long-term engagement by involving users in the valuation process.

- Eliminates human biases and potential manipulations.

- Constant and automatic liquidity, reducing waiting times and fees.

- Eliminates the need for a significant initial liquidity input.

- Market stability, avoiding excessive price fluctuations and high volatility.

- Ensures fair and equitable token distribution.

- Encourages users to support the project through early and active participation with low prices, helping build a solid and diverse user base.

- Transparent and intermediary-free financing.

Challenges and limitations of bonding curves in tokenomics

While bonding curves offer many advantages, they are not suitable for all projects. Indeed, they also present challenges:

- Technical complexity requiring in-depth knowledge of mathematics and smart contract development.

- Since the price is determined by actual demand, revenue forecasting can be complex.

- The need to educate users on how bonding curves work, which can be a barrier to initial adoption.

- Transaction costs related to smart contracts on some blockchains can be high, affecting the efficiency of bonding curves.