Contents page

In the field of tokenomics, the valuation of tokens is essential for several reasons. It directly influences participants’ incentives to contribute to the network and affects the perceived value and credibility of the project in the market. Well-designed valuation mechanisms can attract users and investors, promote liquidity, and support the project’s growth.

Bonding curves represent an innovative mechanism for token valuation, transforming how tokens are created, distributed, and traded.

What is a bonding curve in decentralized finance (DeFi)?

A bonding curve is a mathematical function that establishes a relationship between a token’s price and its circulating supply. Implemented through smart contracts, it automates the creation and destruction of tokens based on supply and demand, without the need for centralized control or traditional order books.

Bonding curves act as Automated Market Makers (AMM), creating an independent market for tokens and ensuring continuous liquidity. They facilitate the buying and selling of tokens at any time without intermediaries, thereby streamlining transactions and reducing associated costs.

How bonding curves work : Example of a linear bonding curve

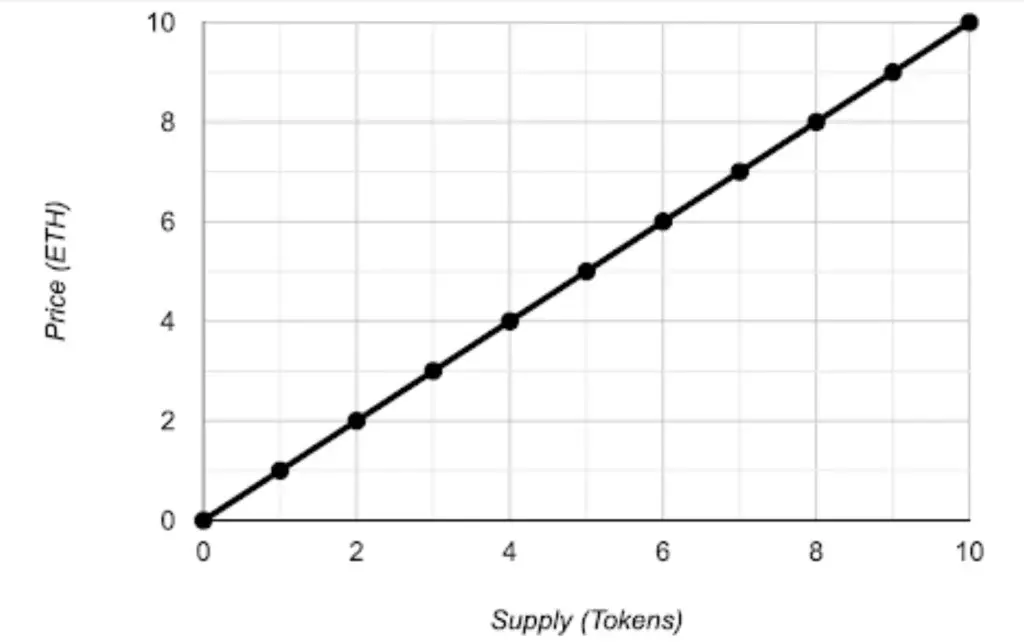

To illustrate the functioning of a bonding curve, consider the example of a linear curve where the price increases and decreases by 1 ETH with each minting (creation) or burning (destruction) of tokens.

- Buying the first token

If someone wants to buy the first token, they must deposit 1 ETH into the project’s smart contract to receive it. This purchase moves the point along the curve, increasing the values of X and Y to 1. The price to mint the next token is now 2 ETH.

- Buying multiple tokens

Another person wants to buy 2 tokens. Since the first token has already been sold, they purchase the second token for 2 ETH and the third token for 3 ETH. In total, they deposit 5 ETH into the smart contract to receive 2 tokens.

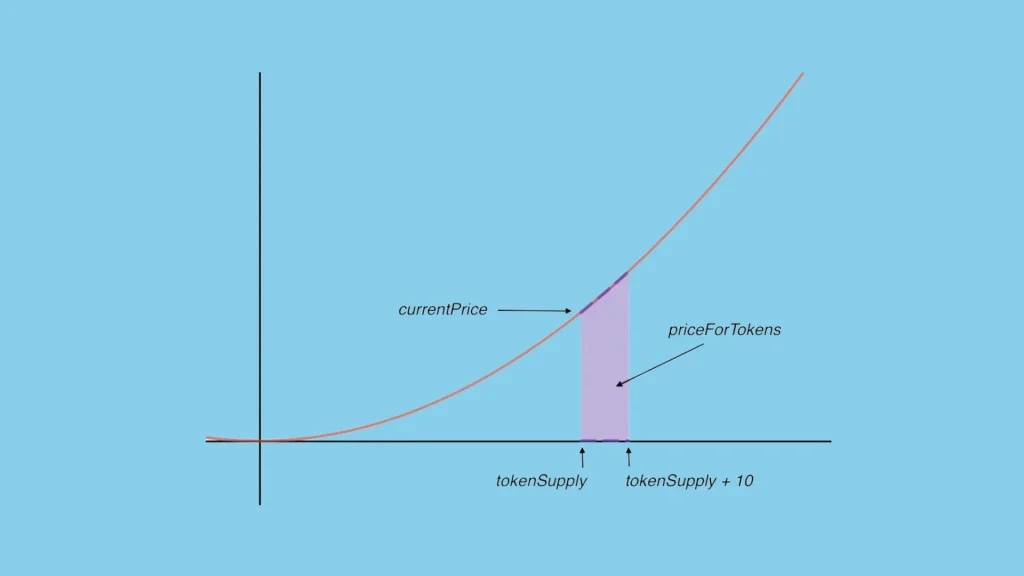

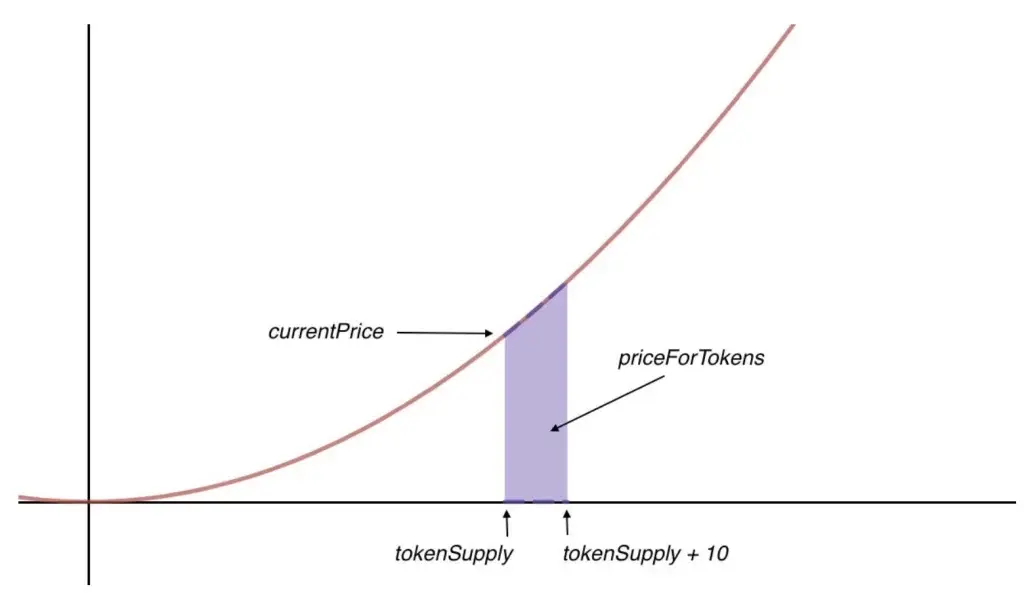

The price of these tokens can be calculated through the mathematical function of the curve and represented by the area under the curve.

Characteristics of bonding curves

Algorithms and mathematical formulas used

Pricing within bonding curves is entirely regulated by an algorithm based on a predefined and permanently coded mathematical formula. Each project can choose the mathematical function that best suits its needs. Commonly used bonding curves include linear, exponential, and logarithmic curves.

Relationship between price and supply

Bonding curves establish a direct relationship between the price of a token and its circulating supply, creating dynamic pricing that reflects real market conditions. When the token supply increases, the price of each newly issued token also rises according to the predefined curve. Conversely, when tokens are removed from the market (burned), the price decreases.

Minting and burning process

The minting and burning process is used with bonding curves to create tokens and dynamically adjust the token supply.

- Minting (creation) of tokens: Occurs when a user buys tokens. The smart contract calculates the price based on the current supply and issues the new tokens. The amount paid using a reserve asset (such as ETH or DAI) is added to the reserve.

- Burning (destruction) of tokens: Occurs when a user sells their tokens to the smart contract. The contract calculates the amount of reserve currency to return to the user and destroys the corresponding tokens, reducing the total supply and adjusting the price accordingly.

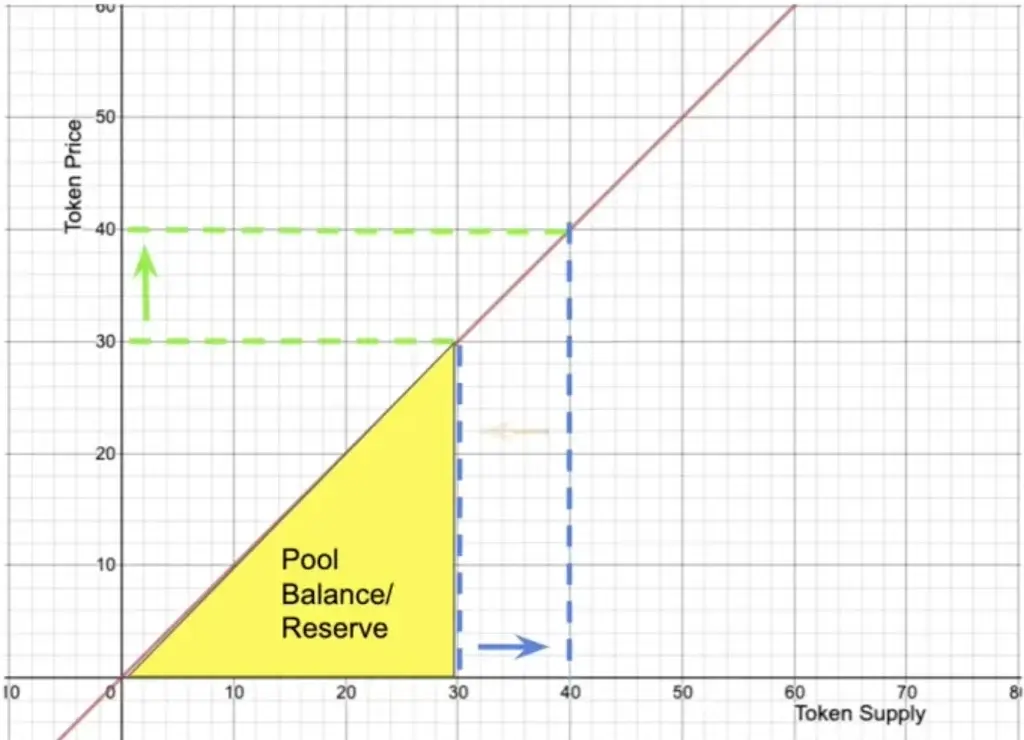

Reserve pool

When a buyer acquires tokens, they pay using another currency or cryptocurrency. This amount is deposited into a reserve pool managed by smart contracts. This reserve pool acts as a source of liquidity, providing a guarantee for the issued tokens. Token holders can sell them at any time using this reserve pool.

The area under the curve represents the price of the tokens when they are minted (as previously mentioned). However, it also represents the value of the tokens in the reserve. It symbolizes the portion of the reserve pool obtained when these tokens are sold, as shown in the graph below.

Therefore, when you buy (mint) new tokens, you add your collateral to the reserve pool. When you sell (burn) tokens, you receive the corresponding amount from the reserve pool. This mechanism provides liquidity without going through a traditional exchange and is regulated by mathematical formulas.

Configurations of bonding curves for Web3 projects

According to the Bonding Curve Research Group, there are two types of automated market mechanisms using bonding curves: Primary Automated Market Makers (PAM) and Secondary Automated Market Makers (SAM). Each mechanism offers specific advantages and addresses different needs in token management and liquidity.

Primary Automated Market Maker (PAM)

PAM are designed to create an initial market for a token. They allow Web3 projects to launch their tokens without the need for an initial liquidity deposit, avoiding the use of centralized (CEX) or decentralized (DEX) exchange platforms. Community members can purchase tokens in exchange for reserve assets. This enables the launch of a token without requiring a large amount of initial liquidity. Additionally, this reduces volatility and offers numerous benefits to the project.

🔎 Learn more about the benefits that bonding curves bring to the Web3 economic model : Advantages of bonding curves in tokenomics

PAM operate with the previously mentioned mechanisms, including the use of minting and burning, reserve pools, and dynamic price adjustments based on token supply through the mathematical function integrated into the token’s smart contract.

- Example of PAM : Aavegotchi

Aavegotchi used a bonding curve to determine the price of its GHST token. Participants could purchase GHST tokens using DAI, and the price increased as the total supply of GHST grew. The purchased tokens can be resold to the smart contract, ensuring continuous liquidity and transparency. This mechanism facilitated fundraising for the project, ensured fair distribution of tokens, and strengthened community engagement.

Secondary Automated Market Maker (SAM)

SAM are used to facilitate the exchange of tokens that already exist on the market. They involve the creation of liquidity pools where the project’s tokens are pooled with a reserve asset. These are the DEXs we know today, such as Balancer or Uniswap, which all use a bonding curve.

AMMs like Uniswap all use a bonding curve and could not exist without this type of curve. Here’s how it works:

Liquidity pool: Token holders can deposit their tokens and reserve assets into a liquidity pool. The price of the tokens is determined by a bonding curve that maintains the product of the quantities of the two assets constant.

Trading: Traders can exchange tokens for reserve assets based on supply and demand, with the price automatically adjusting according to the bonding curve.

- Example of SAM : Uniswap

Uniswap uses a constant product curve, which is a type of bonding curve, to determine the price of tokens in its liquidity pools. This curve maintains the product of the quantities of the two tokens constant, meaning that the price changes automatically based on supply and demand. This allows for continuous liquidity without the need for a traditional order book.

Uniswap has enabled greater accessibility to token trading, reduced transaction costs, and improved liquidity in decentralized markets. The bonding curve model used by Uniswap has inspired many other DeFi projects.

Evolution of bonding curves in Web3 projects

Bonding curves offer numerous advantages to projects during their launch (see our article on the advantages of bonding curves). A Web3 project may choose to launch using a bonding mechanism to take advantage of these benefits. This allows the community to purchase the token at the beginning of the project in a fair and transparent manner. This stage is referred to as PAM (Primary Automated Market Maker), an automated primary market creation.

However, once the project reaches a certain level of maturity, it may decide to list its token on the secondary market. This is done by launching a SAM (Secondary Automated Market Maker), such as a Uniswap pool. Finally, when the project has reached sufficient maturity and enough tokens have been purchased, thereby increasing the circulating supply, it may decide to deactivate its bonding curve. This allows trading only on the secondary market, as the market is already mature.

Once the project reaches a certain level of maturity, it can choose to list its token on the secondary market by creating a SAM (Secondary Automated Market Maker), such as a Uniswap pool. Subsequently, if a sufficient number of tokens has been purchased, increasing the circulating supply, the project may decide to deactivate its bonding curve. This allows trading to occur on the secondary market, as it is now sufficiently mature.

Key takeaways

- Mathematical function: The mathematical function establishes a relationship between a token’s price and its circulating supply.

- Automation via smart contracts: Smart contracts enable the automated creation and destruction of tokens based on supply and demand, without centralized control or traditional order books.

- Continuous liquidity: Bonding curves create an independent market for tokens and ensure continuous liquidity.

- Dynamic pricing: Bonding curves adjust token prices based on circulating supply, reflecting real market conditions.

- Minting and burning: Users utilize minting and burning to automatically create and adjust the token supply.

- Primary Automated Market Makers (PAM): PAMs create an initial market for a token.

- Secondary Automated Market Makers (SAM): SAMs facilitate the exchange of tokens that already exist on the market.

Whether for liquidity management, fundraising, or DAO governance, bonding curves play a crucial role in decentralized finance.

Well explained, recommended this website to all my friends

Adorei conhecer seu blog, tem muito artigos bem interessantes.