Contents page

Vesting is a mechanism in tokenomics that allows tokens or coins to be gradually released over a defined period to the various stakeholders of the project, such as the team, private investors, or partners.

But what exactly does this mechanism entail, and how does it work?

Understanding vesting

Vesting refers to a process through which participants gradually acquire the tokens allocated to them.

Among these methods, linear vesting is the most common. This method is characterized by a uniform and continuous release of tokens over time. For example, consider daily vesting over one year. If a beneficiary is to receive 365 tokens, they will obtain one token each day for 365 days.

Another approach is milestone-based vesting. It relies on achieving specific project goals. For example, team members may be allocated a quantity of tokens when the project’s website is launched. This links rewards to performance.

The vesting period can begin after an initial lock-up phase of tokens, commonly referred to as a “cliff“. Alternatively, it can start immediately at the token launch during the Token Generation Event (TGE).

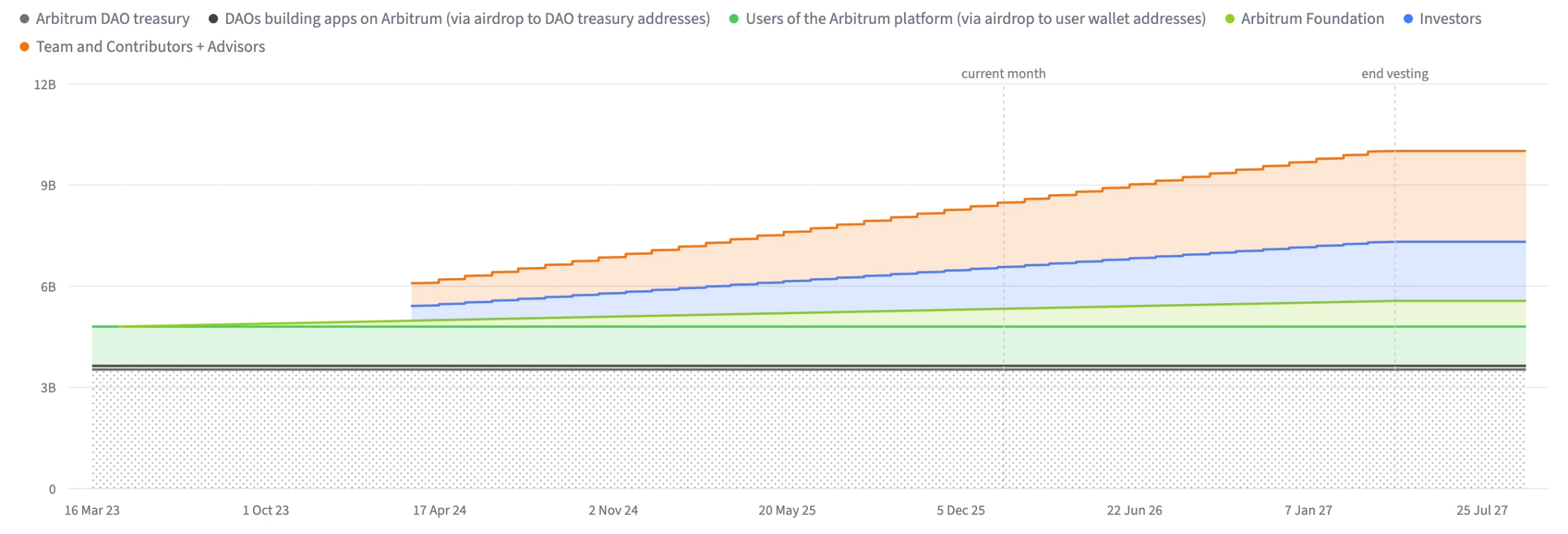

It is often represented in graphical form. Here’s an example with the ARB token distribution schedule of the Arbitrum project.

Example : ARB token of Arbitrum

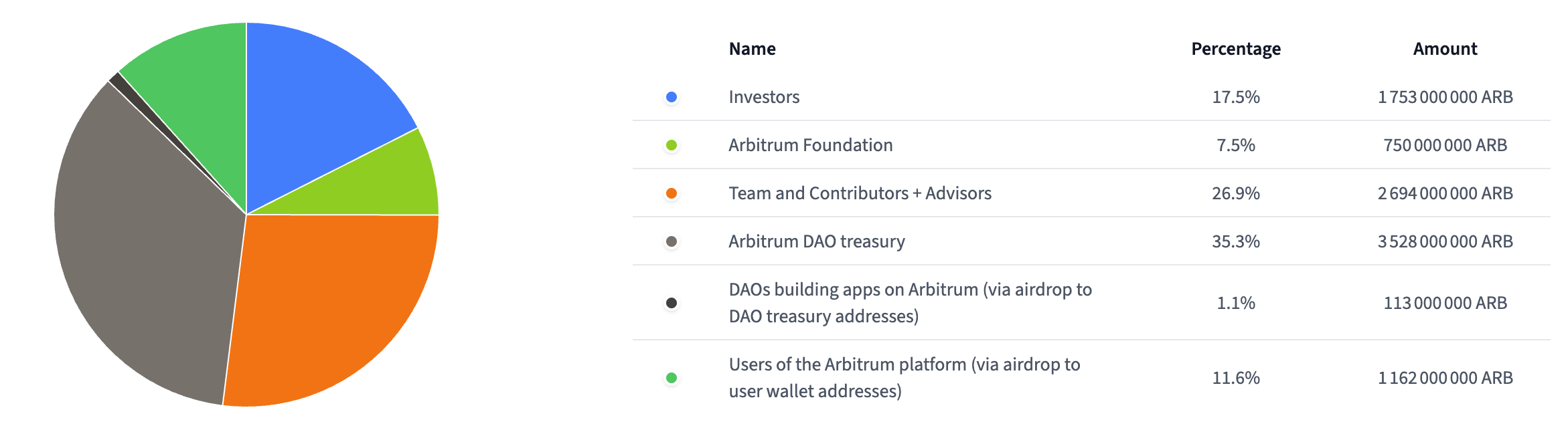

Let’s take Arbitrum’s ARB token as an example. ARB is distributed across six allocation categories: investors, the team (including advisors and contributors), the DAO Treasury, DAOs building applications on Arbitrum, users of the Arbitrum platform, and the Arbitrum Foundation.

The team and investors of Arbitrum are subject to a gradual release of their tokens. Specifically, a monthly linear vesting spread over 36 months has been implemented. Therefore, they receive a portion of ARB tokens each month, calculated based on the total amount due to them. This vesting period began on March 16, 2024, and will end on March 16, 2027. By the end of these 3 years, each member will have received their initially allocated tokens in full.

On April 16, 2024, the teams and investors will receive 92.6 million ARB and the same amount released every 16th of the month.

Conversely, tokens allocated to DAOs building applications on Arbitrum and to users of the Arbitrum platform were fully unlocked at the TGE, with no vesting period or cliff. This means holders received their full allocation at the token launch, allowing them to freely trade their tokens without any temporary lock-up restrictions.

Why is vesting important ?

Reducing selling pressure and volatility

It plays an essential role in regulating token price volatility. By gradually releasing tokens, this strategy helps prevent massive and sudden sales that could significantly drop the token price.

Using Arbitrum as an example. If the 26.9% of tokens allocated to the team and advisors were available immediately without a vesting period, holders could instantly sell their tokens on the market. This action would flood the market with excess supply, leading to a sharp price decline.

However, with vesting, less than 1% of the circulating supply becomes sellable each month by these holders, greatly reducing selling pressure. This spread-out token sale helps stabilize token prices by preventing a large quantity of tokens from being sold immediately after acquisition.

Additionally, this period usually appears at the start of a project and spans 1 to 5 years. This phase allows the project to grow and generate demand for its token, linked to user adoption. This helps maintain a balance between token supply and demand, promoting a stable or gradually increasing price.

Aligning interests and long-term commitment

Vesting is a crucial tool for aligning interests and long-term commitment in projects.

It aligns the interests of key stakeholders, such as founders, developers, and investors, with the project’s goals. Implementing it motivates all participants to stay engaged and work towards a common objective, the long-term success of the project. Team members thus favor sustainable growth over immediate gains.

This approach also discourages investors seeking quick profits. Vesting promotes long-term engagement among those who believe in the project’s potential.

Enhancing credibility and trust

With a vesting schedule, blockchain projects send a strong signal of their seriousness and long-term commitment. Investors and users see vesting as a guarantee that the project’s founders and teams are determined to contribute sustainably. This eliminates situations where projects aim solely for quick profits.

This approach is also reassuring as it protects investors from dishonest practices, such as “rug pulls”, where founders sell off their tokens at launch and abandon the project.

With a vesting plan, founders remain involved and cannot sell their tokens immediately.

What are the challenges related to vesting?

Liquidity risk management

Locking tokens over a prolonged period can reduce available market liquidity, leading to price volatility.

Smart contract security

Projects must ensure proper auditing and security of the smart contracts used for vesting. Any flaws or vulnerabilities in these contracts can compromise the vesting process and investor trust.

Communication and transparency

Projects must provide clear information on vesting, including vesting periods, unlocking criteria, and any exceptions. This prevents confusion or disappointment among token holders.

Key takeaways

- Vesting is an essential mechanism in tokenomics, enabling the gradual and controlled release of tokens.

- This process reduces volatility and stabilizes the market while aligning stakeholder interests with the project’s goals for long-term engagement. Additionally, it enhances the project’s credibility, supporting the sustainable success of tokens in the blockchain ecosystem.

- However, vesting also presents challenges, particularly in liquidity management and smart contract security.